How to Create Fully-compliant GST Invoices and Bills?

September 11, 2024

Are you a retailer or wholesaler looking to create fully-compliant GST invoices and bills? Then, this guide is for you! The guide details in easy steps how businesses, shop owners, and even retail chains can create GST invoices and bills in easy steps. It is not just a mere requirement to issue a GST-compliant invoice—this document also serves as indispensable evidence for tax purposes, in addition to enabling businesses to claim Input Tax Credit (ITC).

This article walks you through the comprehensive approach of creating fully compliant GST invoices and GST bills for retail stores and other businesses.

In this article you will learn:

If you are reading this article, it means you have already registered your business or retail shop under GST. You have a GST number and now you want to create GST bills.

So, why exactly do you need a GST-compliant invoice?

A legal requirement under the GST framework (GST Section 31 of CGST Act 2017) a GST-compliant invoice, serves as proof of the supply of goods or services. Businesses must also collect GST-compliant invoices from their suppliers for hassle-free claims for (Input Tax Credit) ITC.

Exceeding the below revenue limits will require GST registration:

The reasons why GST-compliant Invoice is required:

1. Legal Obligation: Under the CGST Act 2017, GST-registered entities (shops, service businesses, companies, retailers, MSMEs) are obligated by law to provide GST-compliant invoices regarding goods or services sold. Failure attracts penalties and legal scrutiny from GST officers.

In short, if you are GST-registered, you need to bill your customers by issuing GST-compliant invoices. This helps ensure that your billing software complies with all requirements set out under the Act for issuing proper sales documents.

2. Input Tax Credit: Only valid invoices entitle businesses to claim ITC on taxes paid on purchases related to doing business. It has been found that wrong invoicing could lead to a substantial loss in tax savings.

3. Accurate Tax Filing: Compliant invoices result in an accurate reflection in the financial statements made during the filing of returns under CGST thereby reducing any cases involving penalties arising from audits.

4. Financial Transparency: Credibility is built by GST-compliant invoices which indicates that the business adheres to legal standards and accurately reflects transactions.

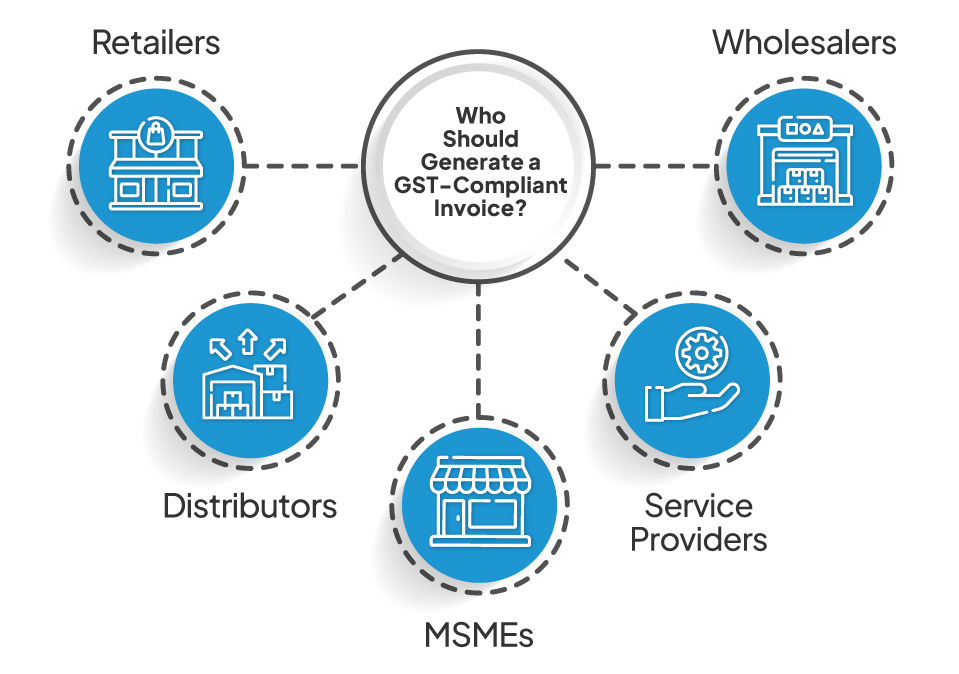

You’ve learned why generating invoices complying with GST is important, but is your business the one that needs to? Any company, retailer, service business, or MSME registered under the GST Act must issue GST-compliant invoices. Both retailers and service providers can benefit from billing software for retail with GST invoicing capability.

The businesses obligated for a GST-compliant invoice are: (if crossing threshold limits and if registered for GST).

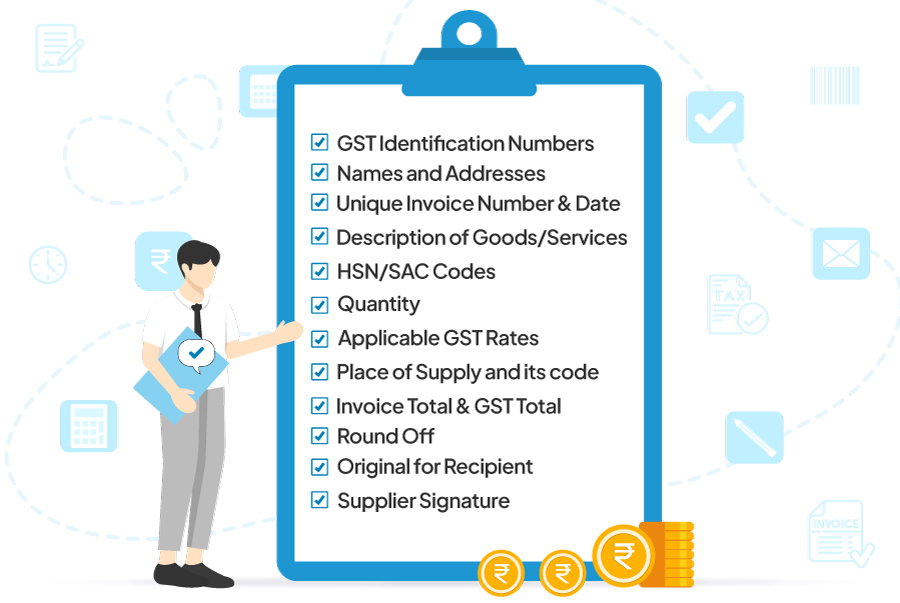

To create a tax-compliant invoice, certain elements have to be incorporated. Below are the primary ones you need to cover:

1. GST Identification Numbers (GSTIN): For both the supplier and recipient, their respective GSTINs should be indicated on the invoice. You will need to incorporate these into your GST-compliant billing software to create valid GST invoices.

Note: If the recipient (in the retail store case the customer) is not registered under GST, you have to put your GST number only.

2. Names and Addresses: The legal names and addresses of both supplier and recipient must be mentioned clearly. (Address is compulsory if the invoice is of more than 50K Indian rupees.

3. Unique Invoice Number and Date: Each invoice should be assigned a unique number for tracking and auditing purposes, while the date it was issued must also be included. For instance, if you start your first invoice as #001, the second invoice will be #002, the third will be #003, and so on.

4. Description of Goods/Services: The supplied good(s) or rendered service(s) should be listed in detail along with the specification or weight. For example Parle G 500 Gm, Nivea Soap 150 Gm, Orient Fan Wendy 1200 mm 3 Blades, etc. If it’s a service, write details like Accounting Preparation Charges for July, Electric Fitting Services, Waterproofing service for the basement, etc.

5. HSN/SAC Codes: HSN or SAC codes belonging to the goods or services being classified are required. Each business and product/services have distinct HSN, and SAC codes. Goods have HSN codes while services have SAC codes. Find the relevant HSN/SAC code for your products and services on the GST website link.

See below how we searched HSN code for stationery items and got the results on the GST website.

6. Quantity: This includes details about the quantity of goods and the extent of services rendered. For instance, if you are selling three units of a Pencil Box or 5 units of a particular Moisturizer, mention them in the Quantity column of the invoice. If it is a weighted category product, then in quantity mention the weight–5Kg Wheat Flour. If you provide content writing services, you will mention the quantity in number of words or if you provide video services, you can mention the quantity in number of videos supplied. Quantity for goods that are sold in meters and centimeters can also be mentioned accordingly.

7. Applicable GST Rates: The total tax amount charged has to include CGST, SGST/UTGST, and IGST rates declared separately along with them. The CGST act clearly and explicitly mentions GST rates for each type of product/service.

Find the GST rates applicable for your business categories (products/services) on the website of the Central Board of Indirect Taxes and Customs.

For instance, if you sell pre-packaged honey within the state, the applicable GST rates are 2.5% SGST and 2.5% CGST. (total 5%). If you sell the same packaged honey out of the state then SGST/CGST is replaced by IGST. In this case, IGST will be 5%.

8. Place of Supply and its code: The place where the goods or services are supplied is significant when it comes to determining the type of GST applicable. Mention the state of supply along with the code of the state. (i.e.: Gujarat (code 24), Rajasthan (Code 08), Mizoram (Code 15), etc.). For exports, the place of supply will be the respective country’s name (the UK, Australia, the USA, etc.)

9. Invoice Total and GST Total: Once all items are mentioned on the invoice separately, at the end there should be a ‘total’. The Total is divided into two categories: sale total and GST total and then the final total is mentioned.

10. Round Off: While not mandatory, you can round off to get the nearest full digit. For example, a GST bill of INR 1200.15, can be rounded off to INR 1200 for convenience and ease of payment.

11. Original for Recipient: The original copy of the invoice will have the Original for recipient written on it. This copy is issued to the customer. A duplicate is retained by the supplier or seller. In case there is transport of Goods involved, a duplicate is issued to the transporter, and triplicated is retained by the seller/supplier.

12. Supplier Signature: The supplier’s signature, either physical or digital, is essential for authentication purposes.

It’s a key factor to include the applicable Goods and Services Tax (GST) rates in GST-compliant invoices. They are the CGST, SGST/UTGST, and IGST. These taxes are for different types of transactions.

This tax is levied by the Central Government on intrastate transactions within a state where both the supplier as well as recipient are in the same state.

For example, should a manufacturer in Maharashtra sell goods valued at ₹10,000 to a retailer also in Maharashtra at a CGST rate of 9%, then CGST will be equal to ₹900 (i.e., (9% of 10,000 = 900)). The central government collects this tax.

On intrastate transactions (both parties are located in the same state), SGST imposed by state governments works hand-in-hand with CGST to share tax responsibility between state and central authorities.

The same transaction worth ₹10,000 in Maharashtra would attract an SGST charge of ₹900 assuming an SGST rate of 9%.

Note: Combining both CGST and SGST gives the total GST for that transaction equal to ₹1,800. UTGST applies similarly to SGSTA in Union Territories without legislative assembly.

IGST comes into view in the case of interstate transactions between different states.

For example, if goods worth ₹10,000 were sold from Maharashtra into Gujarat at an IGTS rate of 18%, then GST will be equal to ₹1,800 (i.e. (18% of 10,000 = 1,800)). The IGST is collected by the central government and then distributed to the participating states.

Before you start to create a GST invoice, what will you require? GST-compliant billing software

If you are a retailer, like a grocery store owner, pet store owner, supermarket, gift shop, or stationery retailer, you have a continuous influx of customers. You cannot use outdated methods like manual bill books or Excel sheets for creating GST invoices. You need faster billing methods like GST invoicing software.

Creating a GST-compliant invoice is a structured process that can be simplified further by utilizing advanced billing software solutions like VasyERP.

Here’s a step-by-step process to help you get started:

1. Choose an Appropriate Invoice Format: Choose between various templates and formats from the specialized invoicing software.

2. Include Your Business Details: Your invoice should contain some important information, such as your business name and address, GSTIN number, and contact details.

3. Add Customer Details: Names of customers from whom the goods were purchased need to appear; they may include their addresses, GSTIN (if applicable), and contact details.

4. Specify Invoice Details: Including the unique invoice number and the date of issue enhances easier tracing of it if lost.

5. List Product/Service Details: In this regard, one has to provide detailed information about them including HSN/SAC codes, quantity sold rates charged per item, etc.

6. Apply the Appropriate GST Rates: This entails calculating appropriate CGST/SGST/IGST rates depending on the type of supply, aka nature of the transaction, and computing the total tax amount accordingly. Retail Billing software should apply correct CGST/SGST/IGST rates based on transaction type or nature.

7. Ensure Total Calculations Include Taxable Value and Taxes: At the end of this document, the total amount payable by the customer is in figures and words.

8. Provide Payment and Shipping Information: The modes, as well as terms of payment plus shipment particulars, should always be stated clearly at any moment when presenting invoices to customers for effective service delivery and to avoid delayed payments.

9. Save and Share the Invoice: Finally, save the invoice in a PDF format via SMS/Whatsapp/Email or print it out.

GST-Compliant POS Billing: For Retail Stores

If you have a GST-compliant POS set up then, invoicing becomes easier for you. You don’t have to input product descriptions or HSN/SAC codes, these are automatically added as you scan the products with a barcode scanner or mobile app (in the case of advanced POS like VasyERP).

Would you like more information about invoicing under GST? Check out some highlights below:

Invoices vs. Bills

An invoice as opposed to bills are more detailed payment requests that are used mostly for business-to-business transactions while bills are used for consumer purchases requiring immediate payments.

E-way Bills

When moving goods around, e-way bills must be produced and kept handy. They play a role in documenting movements as per rules governing transport concerning Goods and Services Tax (GST).

E-invoicing

Using GST invoicing software with an e-invoicing module will be required to adhere to e-invoicing rules and regulations. E-invoicing becomes a necessity if you run a large business where your revenue exceeds 5 crores per year. This includes generating digital invoices that meet the standards of the GST Network (GSTN), easing compliance issues, and ensuring the accuracy of records at all times.

Credit Notes

Suppliers can issue credit notes to amend tax invoices and reduce tax liability. Common reasons for issuing credit notes:

Important: All credit notes issued in a month must be reported in that month’s GSTR-1.

| Can You Amend an Already Created Tax Invoice to Make It GST Complaint? Did you ever need to make changes to an invoice after it’s been issued? Good news – you can modify an already issued invoice to be GST compliant! Here is how it works: When to Revise? If you have sent the invoice before getting the GST registration or if there are mistakes such as incorrect values or GST rates that you see later on, then it’s time for a revision. How to Revise? Within one month of receiving your certificate of GST registration, you will be required to issue another invoice. In this case, ensure that this new invoice makes reference to the original one and clearly highlights any changes made to it. |

Although it might seem challenging to handle GST invoicing, you can do it like a pro with the right tools and knowledge. This not only keeps you on the legal track but also increases transparency and efficiency in your operations since you are compliant with GST rules.

At VasyERP, we have developed cutting-edge retail solutions like GST-compliant billing software that makes billing smooth and easy to execute. Our top-of-the-line POS and GST-compliant billing software is fully packed with GST-compliant features to generate accurate invoices and other bills.

Let us handle all your invoicing needs while you focus on other areas that will help your business grow.

Visit VasyERP now and discover how simple creating and managing GST invoices can be!

Thinking of how to start a cosmetic store in India, now...

July 11, 2025

Explore the latest trends in ERP adoption in India, inc...

January 22, 2026