Mera Bill Mera Adhikar: A Complete Guide to Participate and Win

September 26, 2023

With the Mera Bill Mera Adhikar Reward Scheme, the government of India is incentivizing consumers to upload business-to-consumer (B2C) GST invoices. The invoices issued by genuine B2C suppliers registered under Goods and Service Tax, India from selected states are eligible for this consumer reward scheme.

The Government of India has already enforced the requirement of e-invoices for business-to-business dealings surpassing an annual revenue of 5 crore rupees, as part of an effort to prevent GST tax evasion. This additional initiative will encourage the creation of electronic invoices at the business-to-consumer level, and also give the purchaser the opportunity to partake in the lottery-based reward system for GST invoices.

This article details all the key elements of the Mera Bill Mera Adhikar scheme and its implication on retail B2C businesses that generate GST invoices.

Let’s find it together:

**UT=Union Territory

Gradually, the scheme will cover more states and UTs.

Note: While the B2C supplier who generates GST bills should be registered in the above States and Union Territories, the customer can be from any state/UT of India. He/She should be a citizen of India. This national reach ensures that the benefits of the scheme are accessible to a wide audience, contributing to a more uniform implementation of GST practices across the country.

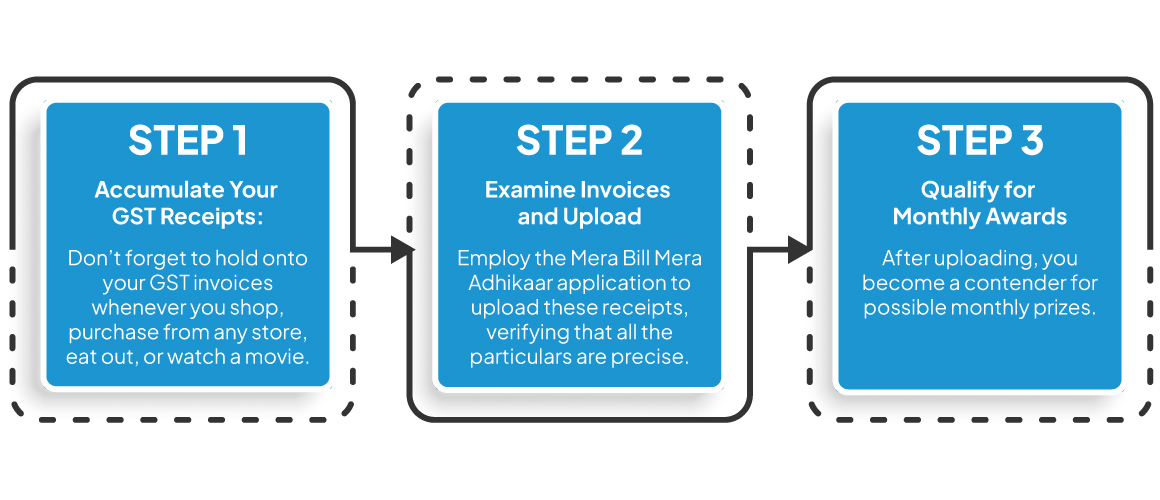

The invoices can be uploaded via any of the three online ways mentioned below:

** A maximum of 25 invoices can be uploaded in a month by an Individual customer.

** The minimum amount of the GST invoice should be INR 200.

Mera Bill Mera Adhikar provides multiple convenient options for consumers to upload their invoices. The availability of a mobile application on both Android and iOS platforms, along with a web portal, ensures that consumers can easily participate regardless of their preferred device.

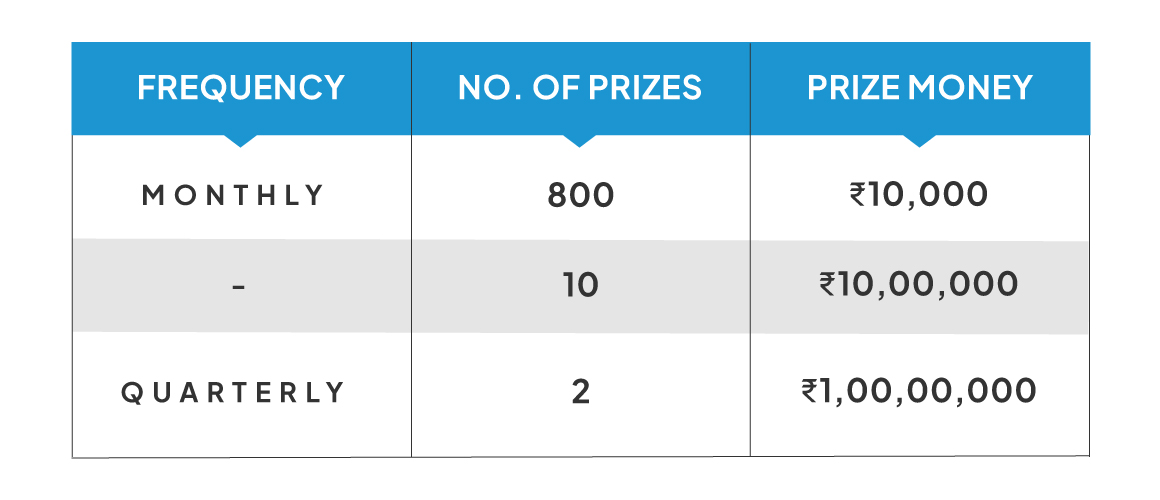

The reward system creates a competitive spirit among consumers, motivating them to upload their invoices regularly. This not only benefits the consumers through rewards but also ensures a continuous flow of data into the GST system, aiding the government in monitoring transactions effectively. Every month through electronic lucky draws, those who have uploaded genuine GST invoices along with their accurate personal details will be rewarded.

One of the key goals of Mera Bill Mera Adhikar is to encourage businesses to generate GST bills. By rewarding consumers for uploading these bills, the scheme indirectly motivates businesses to comply with GST regulations, thereby formalizing the economy and reducing tax evasion.

Transparency in transactions is critical for building trust between businesses and consumers. The scheme’s focus on proper invoicing practices ensures that consumers receive clear and accurate bills for their purchases, reducing the chances of hidden charges or tax evasion.

Mera Bill Mera Adhikar serves as an educational tool to raise consumer awareness about the importance of requesting GST invoices. Many consumers may not fully understand the benefits of receiving and retaining these invoices. This scheme educates them about their rights and the advantages of GST-compliant transactions.

The scheme encourages consumers to collect and preserve their GST invoices from various transactions, including shopping, dining out, and entertainment. This not only helps consumers track their expenses but also empowers them to claim any potential refunds or input tax credits.

By promoting proper invoicing and GST compliance, Mera Bill Mera Adhikar contributes to the formalization of the Indian economy. Formalization is essential for economic growth, as it leads to increased tax revenues, improved credit availability, and better access to financial services for businesses.

Consumers are more likely to buy from retailers that generate e-invoices for several reasons

E-invoices are typically generated electronically and stored in digital formats. This makes it much easier for consumers to upload these invoices using the Mera Bill Mera Adhikar mobile application or web portal. Since the scheme encourages consumers to upload invoices accurately, having e-invoices simplifies the process and reduces the chances of errors.

E-invoices can be instantly shared with consumers via email or SMS. This means that consumers receive their invoices quickly, and they can upload them immediately after a purchase. This speed and efficiency are appealing to consumers who want to participate in the scheme without any delays.

E-invoices eliminate the need for physical paperwork. Consumers don’t have to worry about keeping track of paper bills, which can get lost or damaged. This convenience encourages consumers to prefer retailers who provide e-invoices.

Many consumers today are environmentally conscious and prefer digital alternatives to paper-based transactions. E-invoices align with this preference, as they reduce the consumption of paper and contribute to a more sustainable shopping experience.

E-invoices can be easily stored in digital wallets or folders, allowing consumers to maintain organized records of their transactions. This digital record-keeping is more efficient and accessible compared to physical receipts.

E-invoices generated by retailers tend to have fewer errors compared to handwritten or manually generated invoices. This accuracy is vital for consumers who want to ensure that the details on their invoices are correct before uploading them.

Retailers who generate e-invoices demonstrate a commitment to transparency and compliance with tax regulations. This builds trust among consumers who may prefer to shop at establishments with a reputation for adhering to legal and ethical standards.

Retailers may use the fact that they provide e-invoices as a promotional tool. They can highlight their commitment to transparency and compliance, which could attract more customers who want to participate in the Mera Bill Mera Adhikar scheme.

In a competitive retail market, offering e-invoices can set retailers apart from their competitors. Consumers may choose retailers who provide e-invoices over those who do not, especially if they are aware of the benefits of the Mera Bill Mera Adhikar scheme.

| Retailers that generate e-invoices can attract more customers and have an advantage under the Mera Bill Mera Adhikar scheme due to the ease, efficiency, and accuracy of e-invoice handling. Consumers are likely to prefer these retailers, especially when they are aware of the scheme’s rewards and benefits. |

Mera Bill Mera Adhikar can potentially redefine the B2C retail landscape in several key ways:

Mera Bill Mera Adhikar can lead to a more efficient, transparent, and customer-centric retail industry.

As the scheme gradually expands to cover more states and Union Territories, its impact on the B2C retail landscape is likely to grow. More consumers will become aware of their rights and the benefits of GST-compliant transactions, leading to a cultural shift in consumer behavior. The scheme enjoys support from government officials.

The government’s efforts to educate consumers about the benefits of requesting and uploading GST invoices play a crucial role in shaping consumer behavior. The scheme is a testimony to the government’s commitment to making GST a more integral part of the economy and ensuring that consumers actively participate in the system.

From a consumer perspective, purchasing from retailers offering e-invoices can be more appealing. The ease of uploading e-invoices simplifies record-keeping and claim processes for consumers, making their shopping experience more seamless.

Mera Bill Mera Adhikar can drive customer preference towards retailers that generate GST-compliant invoices, thereby creating a competitive advantage for such businesses in the retail landscape.

If you are looking for a POS system that can create GST-compliant invoices and allow your customers to participate in the Mera Bill Mera Adhikar Scheme, contact the VasyERP team today and avail of a free demo of the services.

Introduction The future of retail billing is digital...

September 1, 2024

Managing expiry and shelf life is one of the biggest pa...

June 11, 2024