How Does Cloud-based Accounting Software Solve Retail Financial Compliance Challenges?

November 19, 2024

All business activities are subject to scrutiny from regulatory authorities like the GST department, the Income Tax Department, and other financial regulators. Retailers, SMEs, wholesalers, distributors, etc. are no exception. Imagine this scenario—your shop floor is filled with buyers exploring products they want to purchase. Meanwhile, you handle financial tasks like daily transactions, ledgers, bookkeeping, etc. The GST regulations and returns filing alone create significant pressure for retailers and small businesses.

This is where you need a helpmate who can complete all financial due diligence and compliance activities on your behalf. Yes, a retail software solution —an integrated and cloud-based accounting software is all that you need. It offers simple and easy solutions, modules, features, and add-ons to solve your retail financial compliance challenges. Through this article, let’s learn how integrated accounting system transforms your retail financial operations and keeps you compliant at every step toward the success journey.

In simple words, financial compliance is the adherence to financial laws, regulations, guidelines, and specifications (set by competent law authorities and regulatory bodies) that are relevant to a particular business process. There can be basic requirements like maintaining account books to complex requirements like conducting yearly audits.

Your business needs to adhere to all standards, rules, and regulations of financial compliance. The very first and most significant reason is that it saves you from legal consequences or fines from the authorities. Even missing the GST filing date attracts penalties. As a retailer, you must even comply with data privacy laws (if you collect your customer’s contact data or save their credit/debit card information). Failure to meet these standards will lead to heavy fines.

However, financial compliance isn’t as difficult as it seems. What you need is technology that can proficiently handle financial management on your behalf. This is where you need the best accounting software in India with features for financial reporting & compliance management specific to the Indian regulatory landscape. Let us see how advanced cloud-based accounting software can not only help in the financial compliance part but also propel business growth.

Imagine how much your business could grow with cloud-based accounting solution integrated with POS, e-commerce, CRM, and inventory management.

Extremely well! Right? All your important financial data and activities—sales revenue, P&L, balance sheet, operating costs, cash flow, expenses, ROI, and more—are tracked, allowing you to stay organized, compliant, and, thus, more efficient. Isn’t it a win-win?

If the countless laws, GST compliance, TDS & Tax compliance, financial documentation, and reporting seem challenging for your business—then a cloud-based accounting software would be all you need!

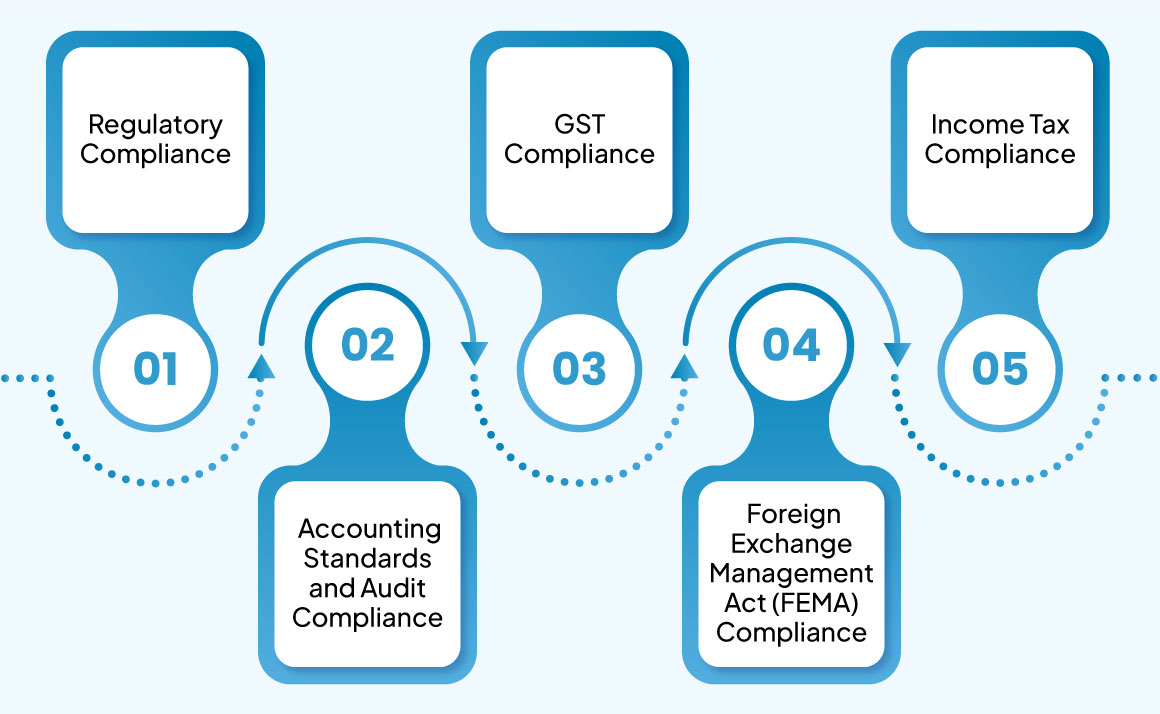

An integrated cloud-based accounting software combines all features needed for accounting management for:

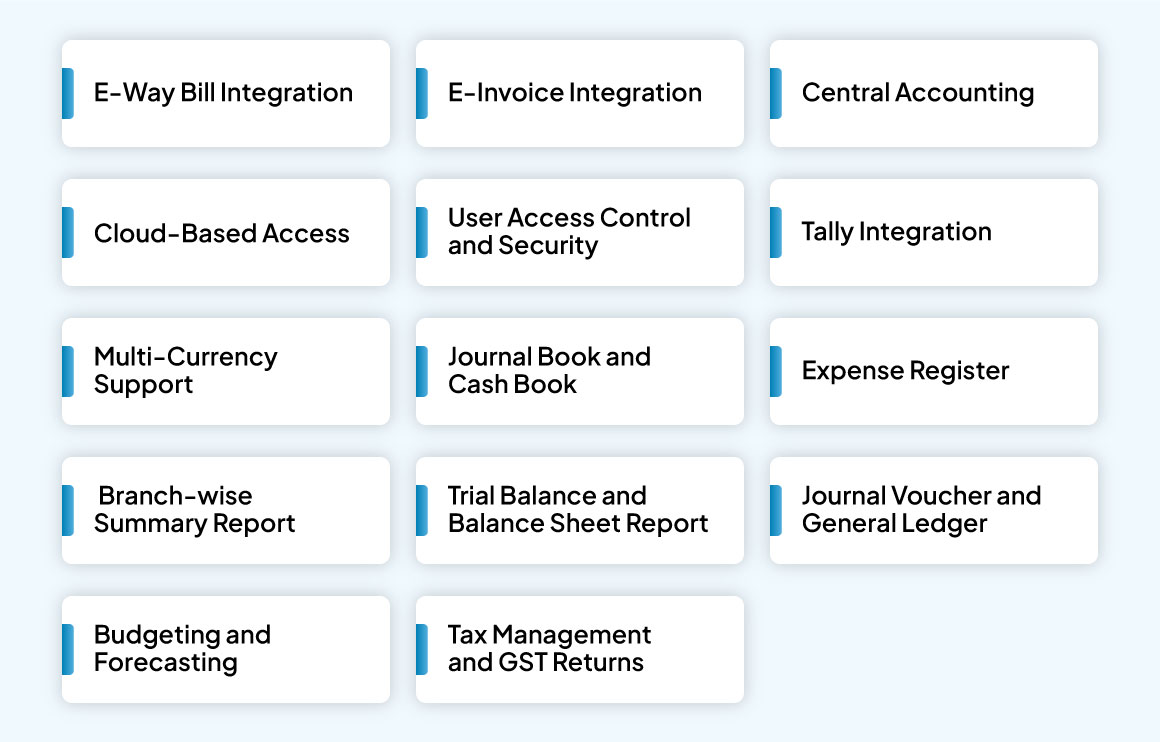

It has extensive features like GST returns, inventory accounting, accounts payable, accounts receivable, financial reporting, e-invoicing integration, tally integration, general ledgers, journal vouchers, tax management, and many more in one place. It also ensures that all financial data is unified and at the tips of your fingers at any time.

Regulatory change is the biggest compliance challenge most retailers face. It means you’ll have to stick to local, state, and central laws governing the operation of retail businesses. It’s no longer about being compliant with the legal rules; rather, it’s more about making the shopping experience safe and fair for the customers and working staff alike. There are compliances like e-invoicing that one needs to follow.

GST (Goods and Services Tax) may easily overwhelm you. Every transaction will first-handily require specific tax calculations depending on the location and product category. What’s more? With consistent changes in laws, GST compliance always needs to be fulfilled to avoid heavy penalties and strict legal action. For this compliance, retailers must:

Income tax compliance (TDS) is another area for retailers in financial compliance. Non-compliance with income tax regulations will attract heavy fines and legal issues. Retailers need to abide by the following:

As a retailer, you are expected to keep your financial records in check as per the accounting standards set by the Institute of Chartered Accountants of India (ICAI). Lack of compliance can cause errors in financial reporting and regulatory audits. Major compliance areas are:

A key compliance area for retailers with businesses involving international trade or foreign investments (supermarkets and hypermarkets) is to conform with FEMA. In case of violation of FEMA, the consequence is severe, with penalties and the business operations being restricted. Retailers need to fulfill:

Know more about annual retail compliance to stay informed and align your retail business to the compliance standards perfectly.

Not every retailer is an accounting pro. Many retailers do not understand how to maintain accounts. Comprehensive documentation, filings before specified dates, and keeping track of changes in regulations are challenges that retailers face as a part of their business operations.

Below are the challenges faced by retailers in financial compliance and reporting:

Let’s accept—GST is complex. There are various GST tax slabs between 0% and 28%. It’s a lot you have to keep track of as a retailer with diverse products.

Preparing accurate invoices is not as easy as it may seem. Moreover, for GST-registered retailers, it is more specific. All GST-compliant invoices must contain all the mandatory details under GST regulations.

It gets tough when you are in a hurry to close a sale. Besides, if the invoices fail to meet the standards, you are risking fines. Handling invoices may quickly turn into a hassle, particularly if you still create them manually.

If you’ve undergone a tax audit, you might understand why it’s no fun. Even your chartered accountant will ask for so many documents.

Cash flow is the essence of any retail business. Still, effective management of cash flow can be a challenge as sales patterns and seasonal demand change.

Let’s discuss financial reporting—something most retailers don’t like but can’t avoid.

You may have observed that compliance regulations are never fixed and keep changing with time—be it consumer protection, tax compliance, or data privacy ethics.

Relying on manual accounting methods yet? If so, you’re likely risking accurate calculations, leading to errors in bookkeeping—miscalculations in sales tax or wrong invoices.

Are you caught up in outdated and old systems? Here, smooth inventory management seems a huge challenge. Improper inventory handling may either run you out of stock or result in excess inventory, tying up your finances and hampering sales.

You need a method to keep financial data secure. As per the Global Risks Report by the World Economic Forum (Pg-52), 95% of data breaches occur due to manual error.

Now that you understand the key retail financial compliance hurdles, you’re probably interested in discovering effective solutions. Address these compliance obstacles directly and enhance your financial operations with powerful integrated accounting software features—your comprehensive answer.

Let’s explore the exceptional accounting capabilities that will help you navigate today’s strict regulatory landscape.

Change your compliance process for the better by getting rid of manual paperwork headaches. E-way bill integration creates all needed transaction documents on its own cutting down on the chance of human mistakes. When you make fewer errors have no holdups, and improve your logistics, you stay compliant and steer clear of expensive fines.

Have you checked out the E-Invoice Integration feature in all-in-one accounting software? You can create invoices straight from the government’s E-Invoice Portal without switching platforms. This cuts out manual data entry and possible mistakes making sure you follow government rules. It also speeds up your invoicing process saving valuable business time. Pick this smart way to boost your retail operations! Indian businesses that make over 5 crore a year need to have e-invoice features in their accounting system.

One major perk of using cloud accounting systems that work together is getting rid of the need to handle multiple systems. Having all your accounting in one place gives you a single spot to see and check out all transactions, which makes it easier to access financial data and create compliance reports. Your team can find the info they need fast without digging through different platforms, which helps keep things under control and makes it simpler to keep an eye on compliance in real-time.

Research shows that implementing cloud-based accounting software can reduce operational expenses by 50%. What’s more, accounting systems in the cloud let you access financial insights from anywhere whenever you need them. These systems help teams work better together, which means they can respond to compliance needs even when people are working from home. Research indicates businesses transitioning to cloud accounting experienced a 15% revenue growth. Importantly, secure cloud infrastructure provides protected storage and handling of sensitive information.

Your financial data is safe since it can only be accessed by authorized personnel via robust user access controls, provided in integrated accounting software. In this case, authorized individuals can change crucial data and records, which helps reduce the risk of data leaks. Better security measures play a vital role in following India’s DPDP Act.

Add Tally to your system—a popular accounting program that lets your retail business combine new features while following the rules. When you buy the top accounting software for small companies that includes Tally, you’re making a smart choice to streamline tasks for people who know how to use the tool correctly. Now, you can get extra accounting options without breaking any rules!

Are you involved in international trade? For retailers who operate, accounting solution with multi-currency support is a game-changer. It allows you to handle transactions across different currencies and ensures your operations with international regulations. This feature protects you from exchange rate changes and helps you meet international tax requirements!

Journal book and cash book functions help you keep precise records of daily transactions, which is crucial to tracking compliance status and creating financial reports. The journal provides a detailed account of all financial activities, while the cashbook helps you monitor cash coming in and going out. Why is this important? It lets you keep an eye on your financial practices and stay compliant.

We all know how easy it is to spend too much, don’t we? That’s why you need to keep track of what you spend. An expense register is the way to go! It makes managing your money a breeze and helps you stick to your budget. When you can see where your cash is going, you can make better choices and avoid messing up your budget.

If you run your business in more than one place, a branch-by-branch summary report can change the game. It gives you a clear look at how each branch is doing. You can spot any odd patterns or trends in your money data letting you step in and make changes before things get out of hand. With this kind of software, following the rules in different areas has become much easier!

Don’t forget the essential accounting reports! The trial balance works as a reliable helper to check that all your ledger accounts have no errors. Balance sheets make it simpler to understand your assets, liabilities, and equity. This data proves useful not just for you, but also for any investors or lenders interested in your business—a benefit for everyone involved!

A smart way to tackle compliance challenges is to keep your money moves running. This is where journal vouchers and a general ledger come in handy. When you record every transaction accurately, you’re not just building financial trust, but also staying compliant. A well-kept general ledger means your financial papers will always show the real picture of your company’s money ins and outs.

Do you have plans for what’s coming? Use all-in-one tools to budget and forecast. They’ll help you guard your funds, handle cash flows, and stick to the rules you need to follow. Good forecasts will boost smart choices about spending and where to put your money.

Tax season doesn’t have to stress you out! Keep on top of your taxes with automatic handling tools. These tools make it easy to file returns and stay up-to-date with ever-changing tax laws. What’s more? The built-in accounting system figures out what you owe, which cuts down on missed deadlines and mistakes.

A fully integrated accounting solution transforms financial management, introducing robust compliance, transparency, and automation of tasks—freeing up time to focus on what matters the most—your business growth!

Future developments in any industry or domain are never going to stop. Companies like VasyERP are working tirelessly to build, upgrade, and innovate new software solutions to help retailers in their business operations.

Retail accounting software must adapt because rules keep changing. Compliance can overwhelm businesses, so future updates should match new laws. This flexibility helps you adjust to different rules. For example, the VasyERP accounting system runs in the cloud, so it can handle changes in regulations with a quick update.

Technology keeps changing and integrated accounting software is part of this change. As we can see, even more powerful tools in the future will have a deep influence on artificial Intelligence and machine learning, making compliance practices even easier. The future holds smart retail that offers solutions to make life easier for both retailers and customers. Automating risk assessment and using predictive analytics will help retailers tackle compliance issues before they become problems.

A trend that’s catching on is how well-integrated accounting systems now work with ERP software and other key business tools. You’ll see everything you need in one spot, which helps ease the burden of staying compliant. These days, the top accounting software isn’t just a standalone program. Instead, it’s part of a bigger package that includes features for other business tasks. This covers things like billing, managing customer relationships, keeping track of inventory, running online stores, dealing with suppliers, and plenty more.

Retail businesses struggling with financial compliance issues can breathe easier thanks to integrated accounting software. This type of software has an impact on financial processes by automating and centralizing them, which ensures complete adherence to regulatory requirements. To save yourself all the headaches of compliance, consider using a cloud-based accounting program that includes all the features (basic and advanced functions) we’ve talked about in this article.

If we are talking about how to choose the right account...

December 12, 2024

It's not surprising that retailers feel overwhelmed by ...

August 31, 2023