Everything You Need to Know About Accounting Software

October 11, 2024

For small business owners, retailers, MSMEs, and wholesalers, the right tools can make all the difference between success and struggle. Having chaos in spreadsheets and manual bookkeeping? Don’t be discouraged!

Accounting software is your power package to keep your accounts and finances in check. Managing funds, GST returns, daily accounting books, transaction entries, and journals can be quite overwhelming for businesses. However, the days of tedious manual bookkeeping or juggling spreadsheets are now behind us. What’s the secret? A seamless accounting software. This powerful tool has revolutionised the accounting workflows and activities of businesses ranging from retailers to wholesalers and MSMEs. Accounting software takes care of how your business tracks transactions, generates reports, and further makes smarter decisions with the help of real-time data analytics. From automating invoices to setting up payroll systems, it strongly forms the basis of financial management.

Whether you’re a small retail shop owner or managing a growing wholesale business, this article will equip you with the knowledge you need to make informed decisions about investing in accounting software. (features, benefits, and strategies to pick the right accounting software solution for your business.)

At the core, accounting software is designed to streamline your financial procedures and make them easier. It records, monitors, and presents an option for analyzing each one of the transactions involved in your business operations. Hence, it gains real-time insights into the overall health of your company’s finances.

Wondering why accounting software is important?

Big corporations in the 1950s started using mainframe computers, to work with simple accounting. With the advent of personal computers and cloud technology, accounting software has emerged as a significantly sophisticated solution providing extensive features beyond basic bookkeeping.

Accounting software automates nearly 75% of accounting activities, greatly eliminating manual efforts and substantially increasing productivity. Ranging from automated invoicing to inventory management, accounting solutions have become an integral part of modern business operations—running seamlessly. To gain deeper insights into how accounting software solves retail financial challenges, businesses can explore solutions tailored to their needs

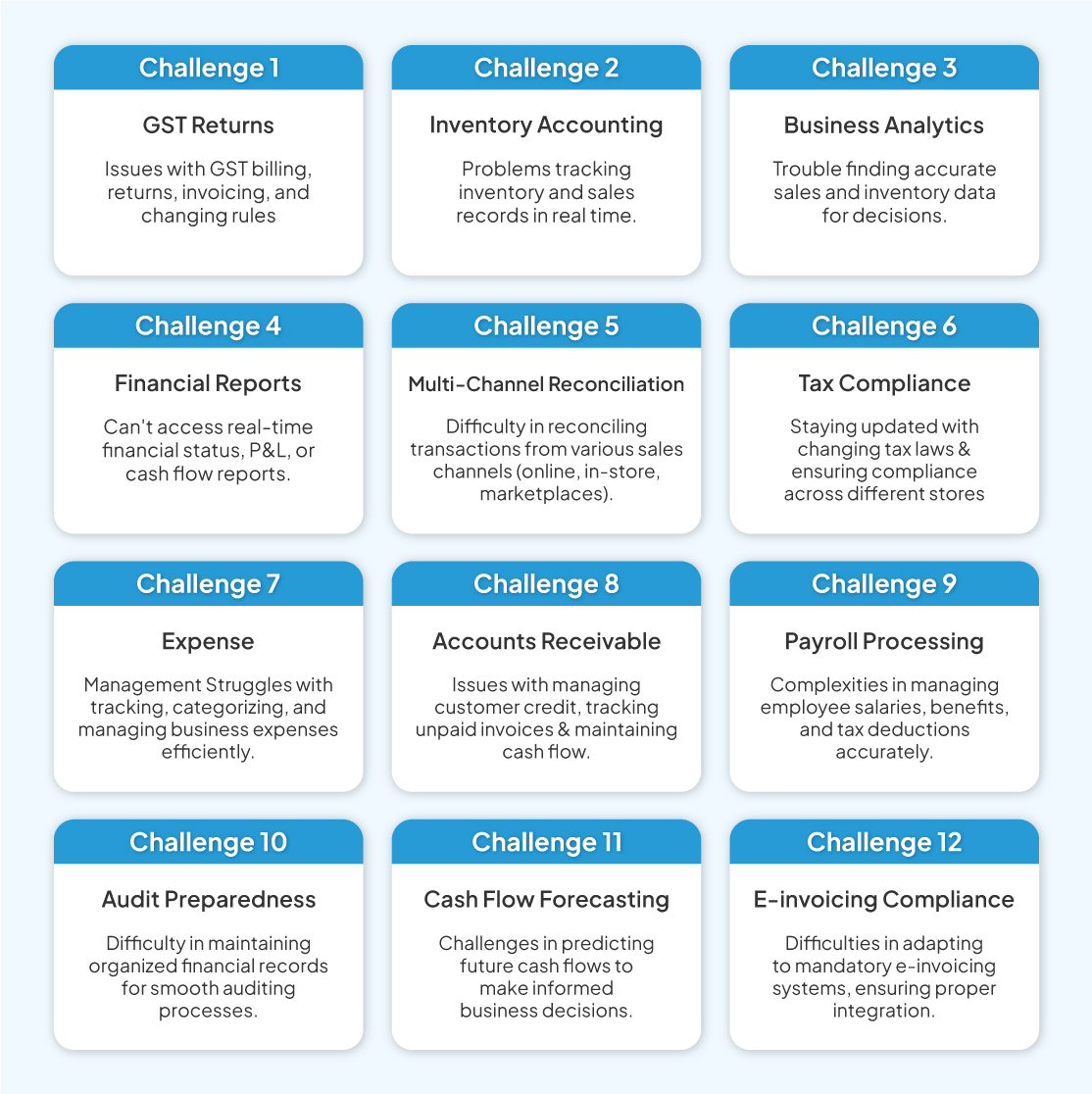

Challenges faced by businesses in managing their accounting activities and workflows

To solve the above challenges, businesses (especially, customer-facing ones) need integrated accounting software that combines POS, inventory, and CRM.

Most accounting software solutions generally have growth-propelling features, making them indispensable in smoothly managing your finances. Here are the main features of accounting software solutions you can get for a robust, well-organized, and successful business:

Tired of creating and handing out invoices manually just to get paid? With advanced GST billing software, that’s now possible. It’s invoicing and billing feature of accounting software does just that. It automates the process of generating invoices. They enable your business to share personalized invoices and track outstanding payments to ensure a smooth cash flow with automated invoicing, access hassle-free invoices/bills, and reduce headaches of manual invoicing.

Accounting software allows you to always keep an eye on your expenses for a robust financial condition. It offers standardized tracking features, allowing your business to organize and track your cash flow with real-time analytics. You can seamlessly upload receipts, track mileage, or even generate a thorough expense report for tax purposes. Using GST accounting software can optimize tax calculations, complying with the latest GST regulations which makes managing company finances a breeze.

The reporting and analytics feature is one of the finest benefits offered by accounting software. This includes generating a wide array of financial reports—from profit and loss statements to balance sheets, enabling you to have a holistic view of your corporate finances. Diverse accounting software solutions allow customizable reports, so you get the exact reports you need to make smart, informed decisions for your business.

It is a crucial aspect for any business to reconcile bank statements with accounting records. A high-end accounting software simplifies business procedure by automating transactions, identifying discrepancies, and creating reconciliation reports. This can further ensure that your financial records are accurate, maintaining a logical audit trail.

Stuck with complex company finances? Now you can integrate payroll with accounting software, which significantly aids in handling your business finances. These solutions deliver computerized calculations of employee wages, taxes, and deductions, assuring comprehensive compliance with labor laws. Payroll management using accounting software enables accurate financial reports and fosters better budgeting and forecasting.

Inventory management is considered a core functionality to track the stock levels of retail businesses. Modern accounting tools often offer this brilliant stock monitoring feature. This accounting software features helps you know the current inventory quantities, create purchase orders, and analyze sales trends. How does that help? It can ultimately streamline your inventory levels, reduce stockouts, and revamp overall financial planning.

E-Invoice Integration automates electronic invoicing, ensuring compliance with regulations. It speeds up payment cycles, reduces errors, and improves efficiency in financial transactions. For businesses with over 5 crores in revenue, e-invoicing is mandatory and the accounting software with an inbuilt e-invoicing feature helps in adhering to this compliance.

E-way Bill generation for goods movement, crucial for logistics and transportation. It ensures compliance with regulations, simplifies management, and reduces paperwork. The system automatically calculates distances, determines taxes, and generates necessary documents.

Tally Integration connects the software with Tally accounting software, enabling data synchronization. This eliminates manual data entry across systems, reducing errors and saving time. It combines Tally’s accounting features with the software’s additional functionalities.

Central Accounting provides a unified platform for managing all accounting functions. It’s beneficial for businesses with multiple departments, facilitating consolidated reporting by aggregating data from various sources. This improves accuracy, enhances visibility, and simplifies comprehensive financial reporting.

The trial balance feature in the accounting system lists all nominal ledger accounts with their debit or credit balances. It verifies bookkeeping accuracy by ensuring total debits equal total credits, helping identify discrepancies in accounting records.

Journal Reports record all financial transactions chronologically, aiding in tracking and auditing. They provide transaction details like dates, accounts, descriptions, and amounts, useful for reviewing specific entries.

GST Returns feature in the accounting software automates the filing of Goods and Services Tax returns, crucial for businesses in countries with GST systems. It ensures compliance and reduces errors in tax filings by automating calculations and form preparation.

Tax Management handles various tax-related activities, including calculations, filings, and tracking of liabilities and payments. It aids in tax planning and optimization, offering features like tax calendar reminders and automatic rate updates. This centralized approach simplifies managing multiple tax obligations.

Budget and Forecasting enable the creation of detailed budgets for departments or projects. It provides tools for financial forecasting based on historical data and market trends. This feature supports strategic planning by helping set goals, allocate resources, and monitor performance against budgets. It often includes scenario analysis for informed decision-making.

Now, since you’ve got a glimpse of what’s accounting software, how accounting grows your business, and why it’s a need, you need to further choose wisely between the main types of accounting software available for businesses—cloud-based and on-premise software. Though each has its pros and cons, you must understand the notable differences before making the final investment. Let’s dive in!

A cloud-based accounting software is a model of accounting applications that are hosted on remote servers and accessed online. The model offers various perks like real-time data acquisition, automated updates, and extensive data security. This gives it an upper hand when compared to the traditional model. Some of the highly recognized cloud-based accounting options include VasyERP, Xero, QuickBooks Online, and FreshBooks.

Below are some of the growth-promising benefits of cloud-based accounting software for you:

Alternately, you are presented with on-premise accounting software also k/a desktop-based accounting software where applications are directly installed on computers or local servers within the premises of an organization. This conventional model comes with a sense of control and security as your data is stored on-premises. The leading on-premise solutions are QuickBooks Desktop and Sage 50 in the market.

The prime benefits of an on-premise accounting software solution are:

While the cloud-based options are present industry leaders, the on-premise solutions have their productive business advantages, mostly towards security.

Beyond these, you’ll come across industry-specific accounting software solutions that are designed to cater to one or more types of industries or business types.

Embracing a recognized accounting software, especially the cloud-based option, fetches a whole array of benefits to your business. You can experience improved efficiency and efficacious decision-making. Let’s learn about the benefits of investing in accounting software solutions.

One of the most significant benefits of accounting software lies in its ability to automate repetitive tasks. These solutions assist by simplifying data entry procedures, invoice creation, and bank statement reconciliation, saving you and your team plenty of time so you can focus solely on business growth and expansion.

With hectic schedules, tight deadlines, and other stressful stuff, human errors are common. Accounting software is less prone to mistakes with automated calculations and inducing constant data entry protocols. This greatly cuts down on the possible errors, which could prove costly, and also ensures compliance with tax rules and regulations.

With efficiency gains and error reductions, an accounting software solution will significantly also save your business the heavy costs it’s obliged to. Businesses can lessen their dependence on manual labor, and minimize the reliance on outside consultants for financial management—a no-brainer!

With real-time access to your financial data and sophisticated reporting capabilities, accounting software enables you to make data-driven decisions with improved accuracy. You are now able to spot trends, predict cash flows, and allocate resources more efficiently—a complete transformation of how you run your business.

If you’re all set to transition to an accounting software system, you may encounter a few challenges. But, no worries at all—with effective solutions provided here, you can overcome these problems. Let’s highlight the common issues you may be posed with and their potential solutions to defeat them just in time.

Migrating data to a fresh accounting platform from legacy systems is quite a complex and sensitive process. For an even transition, the best approach is to concentrate on the integrity of your data, preventing loss, and ensuring compliance with regulatory requirements. Garner support from experienced professionals to help you steadily navigate the process of data migration.

You may sometimes meet with resistance from your employees if they are comfortable with the existing manual processes. However, effective change management allows you to address this challenge effectively such as—clear communication, comprehensive training, and involving your team in the implementation process—it can make all the difference.

Integrating newly acquired accounting software with your current systems without hassle is key to ensuring a cohesive, streamlined business workflow. Integrating the new software across multiple channels (physical stores, online platforms, mobile applications) can be tricky.

Major trends that are expected to mold the future of accounting software solutions for businesses will thrive on automation, cloud-based services, and enhanced data security. Knowing these developments is necessary to streamline financial planning and processes for achieving higher accuracy and competitiveness in your industry.

It would assist you in making smart decisions about deploying the proper accounting technologies that prepare your company for long-term financial success. Grab the most-awaited trends here:

Accounting software can easily integrate with other business applications and platforms, like CRM and ERP software. With integration, you will be able to acquire a holistic look at your finance data, leveling operations, and increasing cross-functional collaborations.

As you move more financial data to the cloud, robust data security measures in accounting software are taking center stage. Expect an improved use of encryption, multi-factor authentication, and conformation with industry standards to safeguard sensitive information.

Automation in accounting software is seeing consistent expansion that has the potential to eradicate manual, error-prone activities—from automated invoicing to predictive cash flow analysis. This increased efficiency would only free up accountants to focus on strategic initiatives.

Opting for the right accounting software can help you streamline your retail business, thus determining the right one is key. With so many options available out there in the market, follow the given steps to make a wise choice:

Identify what you really want and need to have in your accounting software—the platform, the number of users, industry-specific features, and integration needs. This will help you find the software that fits your business operations and financial requirements perfectly.

There are countless top accounting software depending on features, pricing, and user feedback. Consider free trials or demos, which will help you understand the strengths and weaknesses of each platform, fostering informed decisions.

Look for and analyze real-world user reviews to gauge present business scenarios that use accounting software. This can render you the know-how of the software usability, the quality of customer support, and how well its diverse set of features performs.

Proper accounting software not only makes your financial processes easier but also fosters productivity in day-to-day business operations.

Accounting software solutions are all you need in the current world of online as well as offline retail. The software has incredibly transformed the way businesses handle their finances—automating the exhausting manual bookkeeping tasks into easy, data-driven ones. It has further enhanced accuracy with directive insights, minimizing the chances of human error. Such proficiencies make these solutions an irreplaceable aid for modern-day businesses.

Whether you own a small startup or a large business, whether you own a single retail store or chain of stores, whether you are an SME or MSME, or a wholesaler or distributor, accounting software has the power to back you up in reaching smarter, more constructive decisions, streamline your financial processes, and eventually help your business nurture.

If you are on the quest for durable accounting software, research and choose solutions that best fit your business demands. Want to transform your retail business into an industry leader? VasyERP is your one-stop solution—a cloud-based platform that empowers your business ventures with advanced features, optimizing operations, enhancing customer experiences, and streamlining the overall financial management and health of your business.

Small business accounting doesn't have to be complicate...

November 7, 2025

All business activities are subject to scrutiny from re...

November 19, 2024