How to Choose the Right Accounting Software: Tips, Costs and Top Options?

December 12, 2024

If we are talking about how to choose the right accounting software for your business, it means there’s no chance of compromise and you can’t take things lightly. That’s because the right accounting software is key to handling your finances, tracking revenue and expenses, and creating accurate trial balances. It also involves adhering to financial compliance, managing invoicing and billing, and financial reporting.

We understand why most businesses get stuck in this activity. Accounting is overwhelming for retailers, wholesalers, distributors, SMEs, and MSMEs. Managing accounting without an accounting team can be tricky unless you have a replacement. The accounting software is the help that businesses need for solving their accounting challenges.

Hence, this quick guide is here to help you avoid the troubles of opting for the best accounting software that aligns with your goals and sets you up for long-term success. You’ll learn the different types of accounting software, key considerations, and general costs, delivering some insight into the top software options on the market.

Let’s dive in!

Simply put, accounting software is a solution that optimizes and automates your financial tasks. With elevated use and rising adoption across countless industries, the accounting software market is expected to grow at a CAGR of 7.6% from 2024 to 2033.

Key features of the advanced accounting solutions are:

The best advantage of investing in accounting software is that it saves you time and reduces accounting errors, providing you with much more accurate financial insights. If you wish to know more about accounting software, its extensive features, and more, this accounting software guide is your go-to. Now, focus more on tactical decisions that drive retail business growth than wasting hours on hefty manual calculations!

Based on the deployment model, you have two prime options when selecting an accounting software solution—On-premise Vs. Cloud-based. Let’s understand what’s the key difference and determine the best fit for you.

Based on implementation:

On-premise accounting software is installed locally on your server. While it offers full control over your financial data and accounting processes, its maintenance will need an in-house IT team. On-premise accounting software implements robust data security since confidential information is stored on-site, and controlled by the retailer’s IT team. However, this depends largely on the expertise of the IT personnel. Otherwise, poor handling may lead to catastrophic data breaches.

On-premise solutions can be tailored to suit the specific requirements of a business as most of these solution providers offer custom features. However, licensed accounting products under this category may have fixed features and integrations. As on-premise alternatives demand a rigid IT infrastructure and could surge heavy upfront costs for their licensing and maintenance, retailers and small businesses generally look for cloud-based accounting solutions that are more budget-friendly and have low implementation costs.

Some renowned industry leaders are:

Cloud-based accounting software is deployed on remote servers and accessed through the Internet, making it scalable and flexible for retailers. This solution helps you manage accounting from any location, rightly fitting businesses that operate from multiple locations or through remote teams. You’d be surprised to know that a McAfee report highlights that 87% of businesses experience acceleration and 52% experience better security in cloud-based environments!

The best part? Cloud-based accounting software is consistently updated with the latest features and security controls. This keeps the software up-to-date and relevant as per the industry norms.

Some recognized industry leaders are:

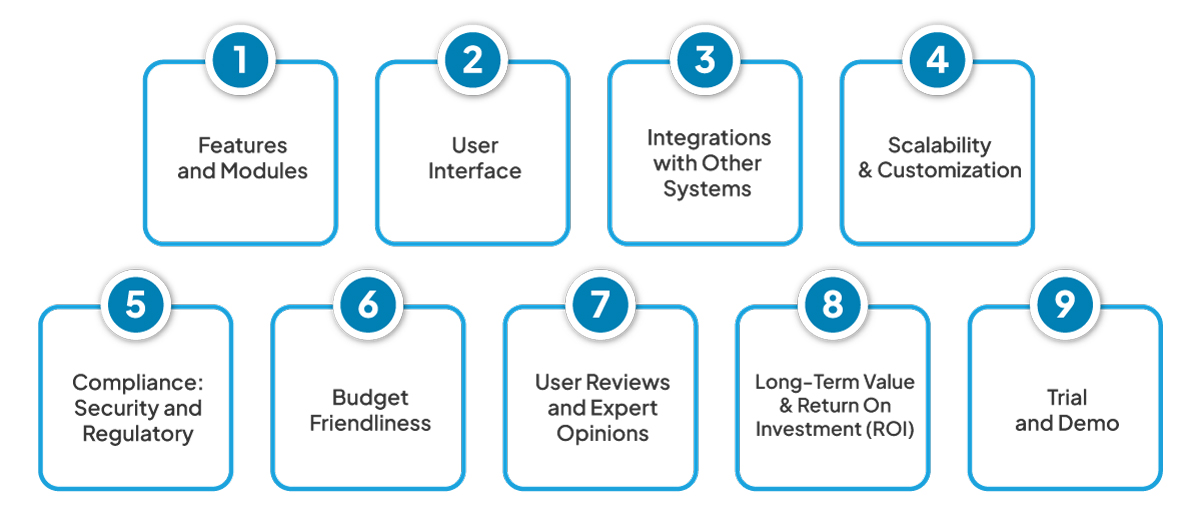

When picking the best accounting software for a small business, you need to go through several important considerations to rightly know which software can serve your business perfectly.

Does the accounting software meet your core requirements like invoicing, GST returns, and financial reporting?

Check if the software has all the features and modules that you need. Understand what you exactly want your accounting software to do for you. Do you need help with:

Consider requirements specific to retail like multi-location tracking or integration with an e-commerce platform. Figuring out these needs will narrow down the software choice suitable for the retail game.

The usability of the software is another determinant of how well it will back your business. A friendly, interactive interface points that you’ll invest less time learning the software and more time using it efficiently.

Look for features like:

It’s also good to consider that the software vendor provides resources for training and customer support. Accounting software providers like VasyERP provide full implementation support, training, and also video resources (tutorials).

Can it smoothly integrate with other software like POS, CRM, Inventory solution, etc.?

Accounting is not a standalone activity. It is interconnected with other activities such as sales, POS transactions, stock purchases, stock returns, etc. Therefore, your accounting software for retail business must optimally be integrated with your other business solutions—a POS, CRM, ERP, or an e-commerce platform.

For smooth and glitch-free integration, consider:

If you are looking for a tool that’s an organized integration of POS, CRM, ERP, and omnichannel e-commerce models—retail business intelligence software can be a game-changer! Effective integration of diverse functionalities can drive endless retail growth and overall efficiency.

Is the accounting software customizable and scalable sufficiently to grow with your increasing business?

As your business expands, your accounting software must grow with it. Today you might have one or two retail stores or business locations, but in the future, you may scale exponentially. Opt for an option that can easily scale concerning data volumes and users without compromising performance. Scalability is key to ensuring the software remains reliable and relevant to your growing business, while customization ensures it perfectly aligns with your processes.

Are the regulatory considerations and data protection features of the software robust?

Financial data is sensitive, and thus, your accounting software should have robust security measures in check. For that, go for features like:

Security and compliance measures back the financial integrity of your business and strengthen trust between you and your clients/stakeholders.

When you dive into the phase of budgeting for the accounting software, keep the following things in mind before getting started:

Adjusting your accounting software costs with your complete business framework and budget can fetch you the most value for the investment.

Did you get insights and feedback from previous clients or read Google reviews?

Once you understand what perfectly aligns with your business goals, read user reviews and expert opinions before finalizing your decision. Google reviews will give you a glimpse into how to use the software, highlighting its ease of use, customer support, and overall functionality. Additionally, expert opinions from industry magazines or financial advisors can give you a more refined view of how the software compares in terms of feature functionality, integration capabilities, and whether the online accounting software can appropriately accommodate your business size and objectives.

Think about the long-term benefits and Return On Investment (ROI) of your accounting software. Ask yourself—how much would this software save you concerning time and money over the coming years or how would this enable your business to make wiser financial decisions?

Just remember these few factors for long-term value and ROI:

Measure these benefits against the cost of the accounting software. Doing so will guide you in making a clever choice.

Instead of taking their word for it—try and test it yourself! Many accounting software sellers offer free trials, training, and demonstrations. Grab this great chance to get a hands-on feel for the software’s interactive interface, functionality, and how finely it connects with your specific business needs.

While in the demo, focus on:

Demo can help ensure that you are satisfied with the software before engaging in a full implementation. If all these considerations are in check, you are absolutely good to go! When you walk through all these questions, you’ll be quite sure that the decision you are making will not just work for your retail business but will place you in the right position for long-term financial success.

Knowing the cost of retail accounting software for small businesses as well as large companies allows you to pick one that fits your budget with zero compromise. While looking for accounting software, you’ll come across different vendors offering an array of pricing models suitable for businesses of varying sizes and needs. Here’s a look into the most common features you’ll find:

It’s one of the most flexible options where you pay a recurring monthly or yearly subscription. The advantage? You can scale up or down depending on your business growth and the features you need over time.

Some software sellers let you pay only once and own it eternally. While the upfront cost accounting software is substantial, it can save you money for life, especially when your business has steady financial regulation needs.

This is ideal if are a beginner or require only basic features. Access the basic version for free and you can always switch to a paid plan later for advanced features. It is perfect for small business owners or freelancers with lighter accounting needs.

While considering these models, to opt for the most scalable and pocket-friendly option, keep in mind factors such as:

Are there any hidden charges? Are the costs transparent?

Now, the upfront cost of Retail POS accounting software is just one side of the picture—a few potential hidden costs may pop up along the road. Have a look:

Carefully planning and budgeting for these extra expenses will give a comprehensive view of your accounting software solution’s total cost of ownership (TCO)—paralleling your budget and financial health.

Now, since you’ve learned how you can weigh your accounting software to match your requirements perfectly, you’ll need to go through the top options out there in the market to figure out what’s best for your business.

Let’s walk you through it!

To help you decide what simple retail accounting software is right for your business, we’ve shortlisted the top choices among industry leaders, along with their key features:

It is one of the best cloud-based accounting software options for Indian retailers, with thorough accounting—automated GST invoicing, expense tracking, trial balance generation, real-time financial reporting, and more. Its user interface simplifies compliance and supports accuracy for seamless business development. VasyERP has no extra cost for integrations (POS, CRM, ERP, Inventory, and Ecommerce). It comes with free training and customer support.

Moreover, VasyERP solves all your financial compliance challenges.

VasyERP is a GST-compliant accounting software for retail businesses. It offers tax calculations, financial reporting, and payment management. With features like inventory tracking, e-way bill integration, and cloud access, it helps retailers ease their accounting processes and maintain tax compliance.

The software is available for a yearly price of INR 24999 for one time subscription. Buy now!

A trusted on-premise accounting and inventory management software, ensuring proper financial reporting, smooth GST compliance, and efficient tracking of stock. It’s further easy to scale, giving retailers a package of user-friendly tools to drive business growth.

TallyERP9 costs INR 22500 plus GST for the perpetual version and if you want to get updates, it will add INR 4000 per year. Its multi-user variant will cost you INR 67500 + GST (18%).

Vyapar is a user-friendly accounting software tailored for small businesses and retailers in India. It offers features like GST billing, inventory management, expense tracking, and financial reporting. Its offline capabilities make it a reliable choice for businesses with limited internet access.

Vyapar’s Silver plan costs around INR 3239 for a yearly subscription and its Gold plan comes at INR 3599 per annum.

Another comprehensive cloud-based pioneer is Zoho Books. It incorporates features such as invoicing, inventory control, project tracking, and even multi-currency support— ideal for small to medium-sized businesses.

ZohoBooks’ professional plan comes at INR 1499 per month if billed annually and its Ultimate plan is INR 7999 per month if billed annually.

Marg ERP is a comprehensive accounting solution designed for businesses of all sizes. It provides modules for accounting, inventory management, payroll, and GST compliance. Its customizable features and robust reporting tools help businesses streamline their financial operations.

Silver edition plan of Marg ERP INR 12600 per year and Gold edition plan INR 25200 per year.

Busy Accounting Software is known for its simplicity and effectiveness in managing accounting tasks. It offers features such as financial accounting, inventory management, GST billing, and multi-location support. It’s suitable for small to medium-sized enterprises looking for an efficient accounting solution.

Busy accounting software costs INR 6999 per year and INR 9999 per year for its Saffron and Emerald plans respectively. It also has plans with limited features.

A cloud-based solution covering all from invoicing to monitoring expenses, payroll, and financial reporting. Being scalable, it is a well-equipped option for small to medium-sized businesses.

QuickBooks’ Essentials plan costs $150 per year (approx INR 12700) and its Advanced plan is priced at $410 per year (approx INR 34500).

Buying the right accounting software solution is quite a big decision that directly controls the financial health and accounting/tax compliance of your business.

Remember, the success of the software strongly counts on the offered feature package and its cost relevance.

It makes all the difference when you accurately understand the different accounting software options available in the market. Carefully assess the key tips for selection, and look at the entire cost implications before you invest in any accounting software.

If you are all set to elevate your retail business finances, your search for the best accounting software ends at VasyERP. It’s an accounting software tailored for small businesses, Indian retailers, retail chains, and even large enterprises.

Schedule your free demo today and witness why VasyERP accounting software is made for you!

Is your mind draining off by organizing your business f...

July 18, 2023

All business activities are subject to scrutiny from re...

November 19, 2024