New Labour Law: Does It Apply to Retailers, MSMEs, and SMEs?

November 23, 2025

Retailers, micro, small, and medium enterprises (MSMEs), and small to medium-sized enterprises (SMEs) in India now have to comply with the new Labour Laws based on their number of employees rather than their business size. This blog post identifies who falls under these laws and how they will affect retailers, MSMEs, and gig workers and provides guidance on major compliance requirements, as well as debunks common misconceptions surrounding compliance for Small Business Owners.

The Indian Labour Ecosystem is on a trajectory of radical change as a result of consolidated labour codes intended to revamp employment legislation. Corporations with huge corporate compliance departments have been preparing for these changes. Whereas small businesses are still trying to figure out whether these changes pertain to them or not. Retailers with small to medium enterprises (SMEs) are very confused. This is because in the past, labour laws were viewed exclusively as being relevant to large factories and enterprises.

The confusion among these companies is not with respect to intent. But rather with respect to applicability (what parts of the new laws pertain to them), compliance costs, and the burden of documenting compliance. Many owners of small and medium-sized businesses struggle with decision-making. The question is whether they should take action now or wait until their business has grown to the size of a larger corporation.

This blog will clarify exactly what the new labour legislation means. It will also take you through whom it applies to and how small businesses can prepare themselves without becoming overly stressed about the process.

India has established four comprehensive Labour Codes that replace many of its fragmented and outdated labour laws; these changes will create one streamlined process for companies to comply with regulations and protect their workforce. The goal of creating a uniform framework is to offer the best work/life balance to employees. This should be done while improving efficiencies for companies doing business in India.

The New Labour Codes replace over 29 existing central and state labour laws with one set of rules and regulations for all employers in India regarding Wage determination, Industrial Relations, Social Security, and Occupational Health and Safety. This will eliminate the duplication of existing laws. It will also eliminate the confusion regarding who is responsible for various aspects of Labour Law Compliance (i.e., payroll calculations, record keeping, etc.).

The key objective of the New Labour Codes is to ensure employees receive their salaries on time and obtain a minimum wage regardless of location, as well as to expand the provision of employee benefits to provide a greater level of protection for the employee. In addition, it is the intention of the Government of India to make it easier for companies to comply with the Labour Codes. This can be done through online digital filing and fewer record-keeping requirements. Self-certification is particularly advantageous to small businesses. This will allow smaller businesses to meet the requirements of the New Labour Code India 2025.

Many people wrongly believe that a Labour Reform is dependent on the size of the business. This is incorrect. The applicability of the labour reform revolves around employment relationships. It does not revolve around business revenue or scale of operation.

The labour reform codes only address how many and what types of employees a business has, not its revenues or description as “Proprietorship,” “Partnership” or “Private Limited Company.” For example, a business will be subject to certain provisions (once a certain number of employees are hired). If it hires an employee be they full-time, part-time, or contract.

The Labour Reform applies to retail, MSMEs, SMEs, and service provider entities that employ persons as defined in the Labour Reform codes. This includes sales, back-office, warehouse, and support staff. The regulation of MSMEs under Labour Reform does not have a standardised application of each provision. Rather, the various labour reform provisions is dependant on the employer’s employee count.

Retail businesses depend heavily on their frontline employees working during shifts and hiring temporarily to meet demand based on the season. Employers in retail have specific labour laws detailing minimum wage levels. It also includes requirements concerning overtime and how many weeks off are required for a week to be considered a full week of unpaid work. Furthermore, it includes the maximum number of hours in between paying to their employees.

Retailers now need to have documentation of their employees’ attendance records. They will also need to have proper documentation wage statements and job descriptions for all employees. Whether an employee is employed permanently or temporarily, the labour law provides the same protections. This is done with regard to wages and the safety of their working conditions. And retailers will not be able to use informal and non-compliant methods of employment. Although these requirements may seem overwhelming for some retailers, they also provide a sense of structure. They will also provide the chances of a retailer being penalized for inconsistently complying with the labour laws governing their employees.

Small and medium enterprises (SMEs) and micro businesses (MSMEs) will benefit from increases in the amount of simplified compliance requirements available to them under the new framework. As the number of employees increase, so do the compliance requirements that come with larger companies. This creates no burdens for micro and small companies when compared to mid-sized companies. With the implementation of the new Labour Law for SMEs and Retailers, eliminating some forms of inspection based will no longer cause fear within the majority of providers. Ultimately, many of the regulations will create a new level of comfort for businesses as they grow.

An important change that has occurred is the recognition of gig and platform workers under federal law. There is now legal recognition of individuals who deliver goods or provide services via apps or contracts. Companies that are in the e-commerce sector and have an employee base primarily composed of contract workers must provide social security contributions. They should also provide some types of basic welfare benefits to their employees.

Although gig and platform workers do not have traditional employee status. They are entitled to certain benefits (such as insurance and a provident fund). This is done through entry into certain government programs. This increased scope of protection for gig and platform workers preserves the ability to provide employee benefits to these workers. It is done while allowing greater flexibility in the way that platform-based businesses structure their operations.

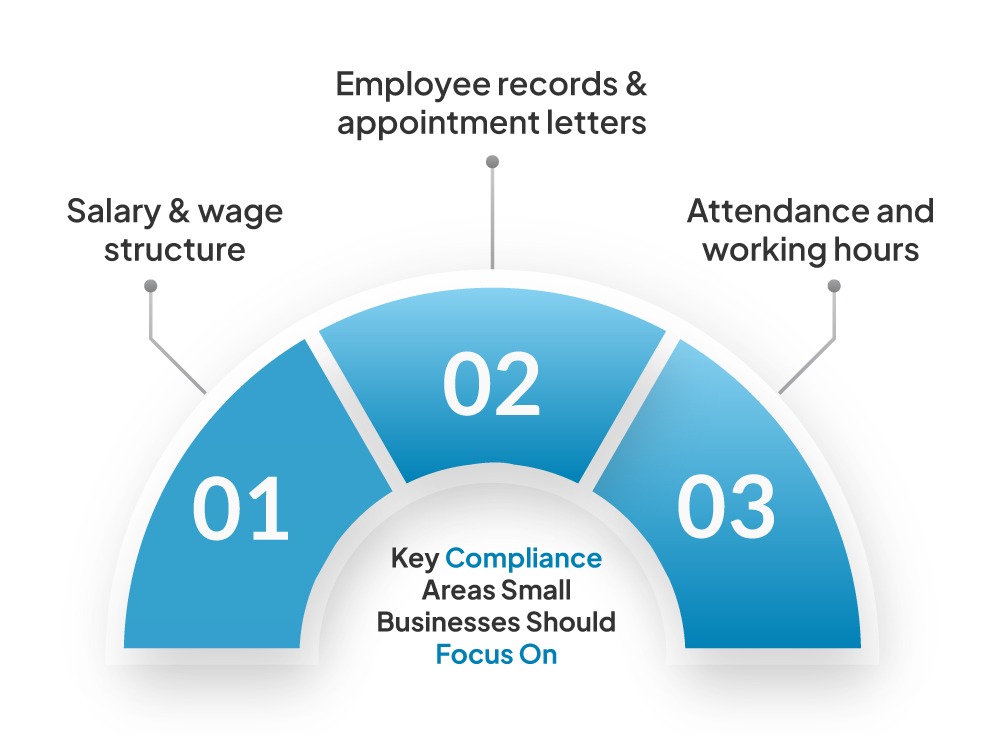

For many small businesses, Compliance doesn’t equate with complexity; it represents reliability. Rather than focusing on many aspects of Compliance, concentrating on four or five core elements will drastically lower your Legal Liability Risk.

Salaries must be paid, as per the Minimum Wage Statute, and at the stipulated time. Wages may only be classified as such when they conform to the established Wage Structure. A clear delineation of the base salary, the allowances, and the deductions of an employee’s compensation are now more important than they have ever been.

Accurate attendance records with defined work hours eliminate litigation risks and help to avoid Workplace disputes. In addition, all employers must adhere to the law. These laws can be regarding overtime and maintain documentation on any days off that are worked by employees. Digital attendance systems help ensure compliance. This is done while also dramatically decreasing the amount of manual errors.

Maintaining basic records for each Employee (appointment letters, job descriptions, wage details, etc.) is crucial. Even the smallest employer will benefit from the creation of written employment agreements. This written documentation clearly demonstrates to the Employer and the Employee what is expected of them. This clarity helps to reduce the number of misunderstandings that arise in an audit or litigation situation.

Many businesses delay complying with labour and other employment laws due to the numerous misconceptions about these laws. By separating fact from fiction, businesses can better prepare and make educated decisions regarding compliance.

Labour law applies to all businesses, regardless of their size or number of employees. In fact, Labour law covers all industries and sectors. If a business has even one employee, it may be subject to some type of labour or employment law. Therefore, even very small businesses, such as mom-and-pop shops with only a few employees, must comply with such laws.

Compliance with all applicable labour or employment laws is mandatory for all businesses. Therefore, while obligations are less burdensome for smaller businesses, they should adhere to all applicable laws to avoid the potential for fines or other penalties. Moreover, by complying with basic labour laws, businesses will help protect both the employer and employee from future legal issues.

Small businesses should begin their review of their current employment practices, including how they pay employees, how they track hours worked, the hours of work that were in place, how they document employee records, and their contracts. The goal at this point is not to be fully compliant overnight, but to get to a minimum level of alignment with the new rules and regulations. Even small steps can have a large impact on how small business owners operate their business legally.

By creating a compliance plan, small business owners will identify what they currently have in place. They will also identify what areas of compliance require attention. The most important items to prioritize are providing timely wage payments. It also involves issuing written appointment letters and having clearly defined jobs for each employee. By prioritizing these items, small business owners will assist in reducing the potential for confusion. It will also provide their employees with a more organized and structured workplace.

The implementation of digital payroll processing systems, attendance tracking systems and storing employee records electronically will greatly reduce the amount of time and effort. This is needed by small business owners in completing these tasks and significantly lowers the likelihood of making errors. Many affordable digital tools are specifically designed for the small business owner that do not require technical skills to use. Small business owners can also consider consulting with a compliance or labour advisor. This is done for an initial one-time compliance audit to obtain clarity on their obligations. This will further help them avoid costly mistakes in the future.

By following a proactive compliance approach, small business owners build credibility with their employees. It helps develop a strong level of trust with their employees and prepares them for future growth. It is done without experiencing any unexpected regulatory issues.

The purpose of the new labour framework is to create clarity, consistency, and fairness in employment practices rather than to place additional requirements on small businesses. Retailers, MSMEs and SMEs are part of the framework’s target audience but whether they are covered by the framework depends more on the nature of the relationship between employer and employee than it does on the size of the retailer/MSME/SME.

Small businesses will be able to make the necessary changes to comply with the requirements of the labour framework by being aware of their core obligations and understanding which areas affect compliance the most. Staying up-to-date on changes to the labour framework (and all other related legislation) as well as keeping accurate and up-to-date documentation will help small businesses comply with their legal obligations and to be able to readily adapt to comply with changes to this regulatory framework as they are introduced.

1. When will the new labour laws be fully enforced for small businesses?

The time frame for the enforcement of labour laws depends on the state as labour is a concurrent subject in India. The States are required to publish their rules after the Central Codes have been published. Therefore, it is important for small business owners to keep abreast of State notifications and proactively prepare in advance of the final enforcement date.

2. Do family-run businesses need to follow these labour laws?

Family members working without remuneration will not be subject to many of the stipulations under the Labour Laws. However, as soon as there are employees not related to the owner or remuneration paid to employees, there are obligations under the Labour Laws. Clearly defining the Business Owner’s and the employee’s roles and establishing a payment structure will clarify any confusion during an inspection or a dispute.

3. Are penalties strict for first-time non-compliance?

The new framework is designed to emphasise the need for corrective action as opposed to punishment, particularly for lesser offences/first offenders. There are provisions found in the new framework that allow the employer to remedy a situation within a certain time frame. However, failing to comply or intent are still grounds for financial penalties.

4. Can small businesses outsource compliance work?

Always. Small businesses can hire third-party service providers to handle payroll, record-keeping and compliance filing, which takes away the labour-intensive aspect of administration and creates an accurate record. Outsourcing is typically less expensive than hiring in-house consultants and specialists.

5. How do labour laws affect business expansion plans?

A good understanding of labour obligations early in the process allows a business to better prepare for the transition of becoming a larger employer. If a business has a growing employee base, additional obligations become applicable at different levels, and the business can avoid interruptions and problems during its transition to larger employers by creating a plan for addressing these requirements.

This blog explains the list of smart retail reports tha...

July 18, 2025

In the past, the concept of inventory referred to the c...

January 1, 2026