How to Set Up E-Invoicing for Your MSME?

December 29, 2025

The guide to e-invoicing for MSME’s provides the criteria for eligibility and turnover limit. It further describes what is needed to successfully operate e-invoicing systems. The guide provides an easy-to-understand step-by-step process. It also outlines how an IRN/QR Code is generated as well as features offered by e-invoicing software for MSME’s to assist users in generating accurate invoices. It also suggests solutions that MSME's could use to facilitate compliance and automate invoice processing with tools such as VasyERP.

E-Invoicing for MSME consists of the electronic validation of B2B invoices through an invoice registration portal (IRP) created and managed by the Government of India. Upon validating a B2B invoice through the IRP, the invoice is deemed valid under the GST. Plus the validated invoice receives both an Invoice Reference Number (IRN) and QR Code.

In addition to meeting the Government’s requirements, MSEs must also become aware of how to validate B2B invoices created. In order to validate B2B invoices for the purpose of the GST, e-Invoice compliance will require all eligible MSEs to generate an IRN. This should be carried out for all B2B invoices issued under the notified categories. This enhanced compliance expectation is aimed at improving invoice reporting accuracy. It also helps reduce invoice fraud and facilitates seamless data flow into the GST registered return. This is filed by each business and the respective GST in which they are registered.

Although meeting compliance expectations is an important benefit for MSMEs, e-Invoicing provides numerous other benefits to MSMEs. This includes the reduced number of manual entry errors among several others. As MSEs prepare to scale their business operations (especially MSEs that have achieved growth through e-commerce). The adoption of a structured invoicing system can provide the MSE with increased efficiency and accountability to their customers.

As before you start implementing e-invoicing for MSME, it is necessary to establish if your business qualifies. This qualification is stated under the government-mandated threshold based on annual revenue. The government periodically changes the turnover limit, which can lead to confusion among MSMEs regarding whether they need to comply. By understanding whether your business meets the criteria for e-invoicing compliance, you can reduce the risk of being penalized. Plus you can also reduce the risk of having late reporting and/or incorrect GST Returns when you file them.

According to the latest Government Notification, businesses whose total turnover is above or equals ₹5.00 Crores in any financial year beginning during the 2017-18 financial year or thereafter will be required to comply with the e-invoicing regulations. The total turnover includes all taxable, exempt, and export and inter-State supplies that are made under the same PAN. To ensure eligibility, MSMEs should calculate the total turnover from all GSTINs under their PAN. Regardless of where geographically an MSME Company is operating, the e-invoicing compliance requirement will apply once the MSME Company crosses the ₹5 crore revenue threshold.

The e-invoicing for MSME requirement will apply to all registered suppliers who issue invoices for B2B, Export or SEZ Sales. However, there are certain types of businesses that will be exempted from the e-invoicing for MSME regulations. This exemption has been set in place regardless of their revenue level. This includes the Banks, Non-Banking Financial Companies (NBFCs). It also includes the Insurance Companies, Goods Transport Agencies (GTA) and more. In addition, MSMEs that sell to consumers and only conduct B2C transactions are not required to comply with the e-invoicing rules. This is an exempt until they sell a single B2B product and if their total revenue exceeds the ₹5 crore threshold.

Small and Medium Enterprises (SMEs) need additional help with interpreting and understanding the current rules because of all of the changes made to them. With all of the changes, it is difficult for SMEs to determine how to implement the new rules because of the lack of clear guidance. It seems that SMEs are confused about the basis for turnover being PAN-based. They are confused whether compliance is required for exempt units or whether B2C businesses issuing an invoice must create an IRN. Moreover they also have confusion about how a misinterpretation of the GST classifications will slow the onboarding process. The following are examples of the confusion that SMEs regularly face:

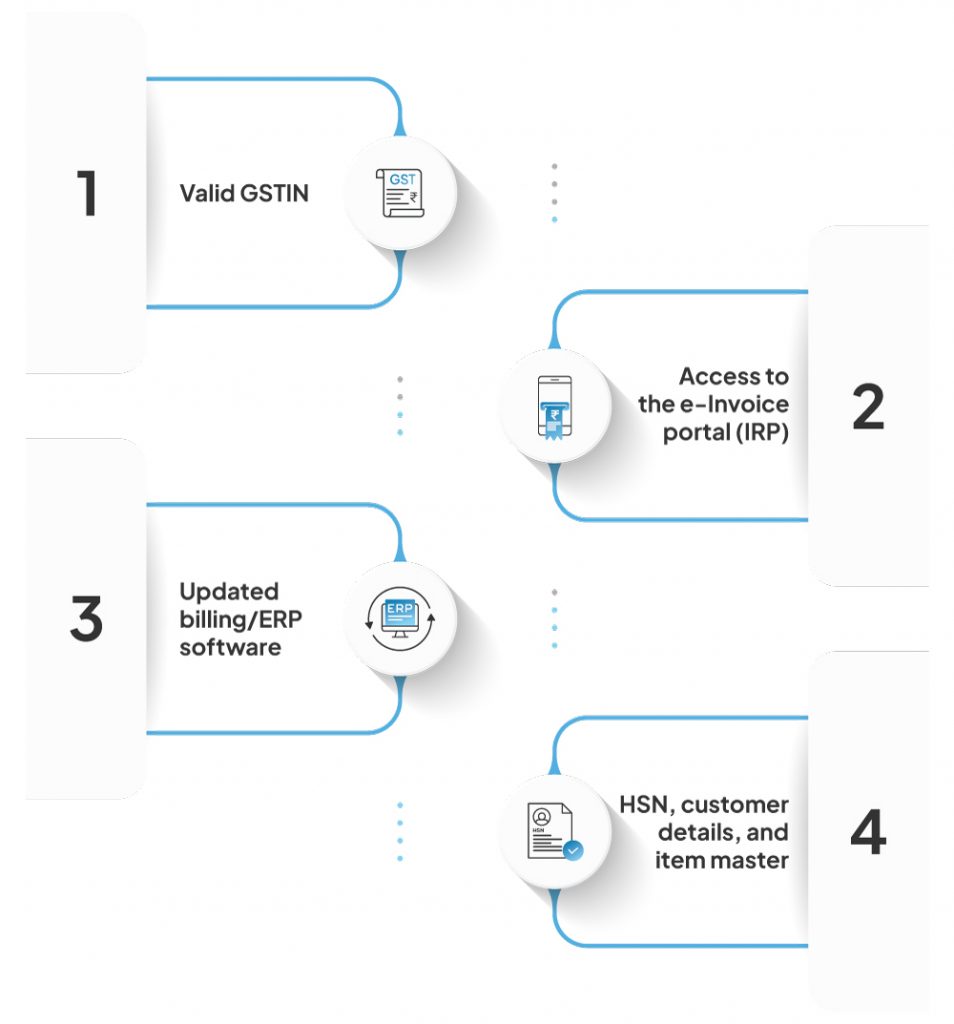

It is crucial that before starting the e-invoicing implementation process, businesses have technically compliant systems and E-invoicing software prepared, to create an efficient onboarding experience. By preparing documentation in advance, businesses will significantly reduce the time frame associated with adopting the mandatory structure.

Registered with a GSTIN, an MSME must have an active GSTIN, that has been properly registered. The GST portal should reflect the current details of the business, including its name, address, business type, and contact information. If any of the business’s information is incorrect or outdated, there may be a mismatch. This mismatch can be there when generating the GST invoice registration number (IRN). All data is validated through the GST system by the Invoice Reference Portal (IRP), so any small discrepancy will lead to an IRN rejection. It is very important that MSMEs also make sure that their Aadhaar Authentication/I.D and their mobile number have been registered.

In order to start generating e-invoices, businesses need to have access to the Official E-Invoice Portal, where the authentication of the invoice occurs. Generally, MSMEs will use the same login credentials as the GST Portal. But first-time users must register to create a Profile for the E-Invoice Portal. Once registered, each MSME will be assigned a Profile Identifier (PID). This, in turn, provides access to the bulk upload tools, the Application Programming Interface (API) for integration, and the means of entering invoices directly.

Your billing tool or ERP has to generate invoices in JSON format as well as interface with your existing system via API. Software that is outdated will not be able to communicate with the IRP. Now this is because they are unable to generate an e-invoice. This, in turn, will also cause an error when you attempt to submit the invoice or it will never get submitted.

Before you can submit the invoice to your IRP, you should confirm your current software does support e-invoice IRN generation (in other words, that HSN codes, GST rates, billing addresses, shipping addresses, and customer GSTINs) are all complete and accurate in your system. Missing or incorrect data will likely cause your invoice to be rejected. Keeping your Item Master updated ensures all invoices submitted comply with the requirements of E-invoice for MSMEs. And, therefore, reduces the potential for manual corrections to be required after submission.

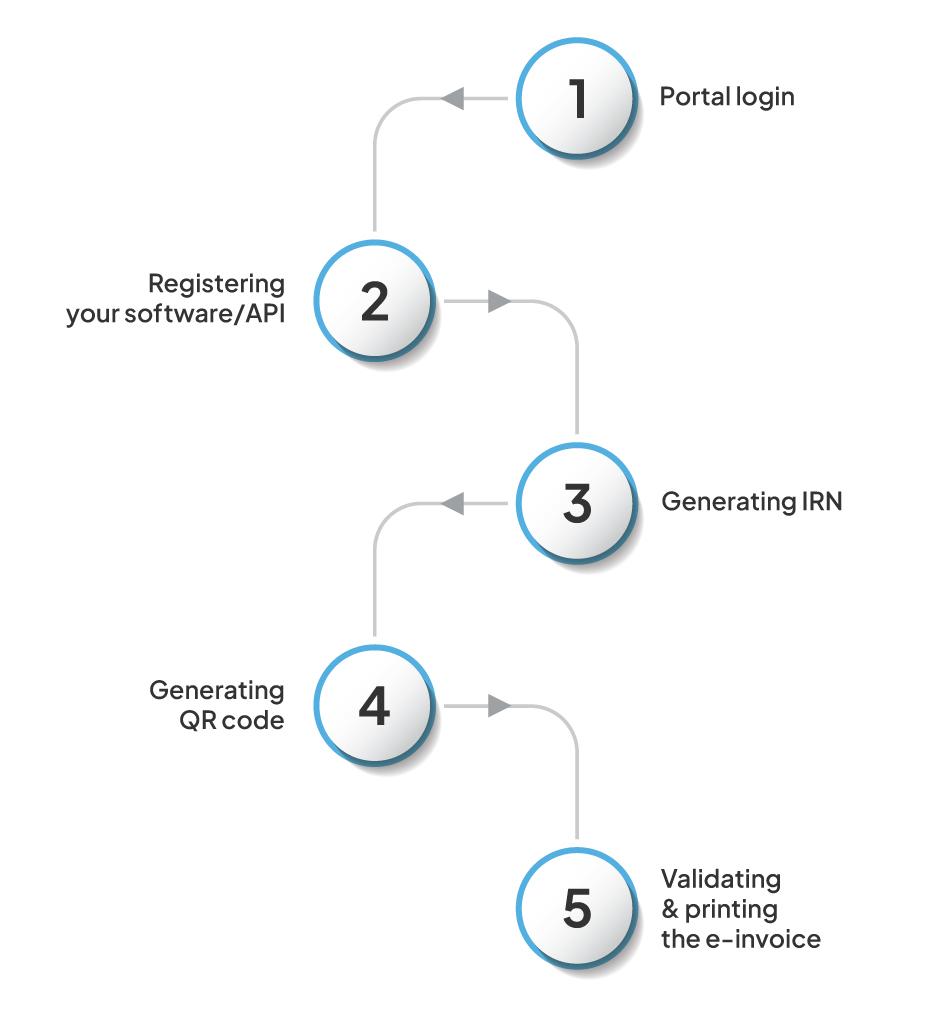

After you have completed the requirements to set up your MSME e-invoice process, you can start using the process for your business. There are three primary e-invoice registration steps and components of setting up your e-invoice: registering your business on the IRP and second is connecting your business software to the IRP. The third is learning the order in which to generate your invoices to verify their authenticity. Completing these steps will result in each invoice that you generate being authentic, compliant with GST, and legally accepted by the government.

Logging in to the Portal To log into the IRP Portal, you will need to go to the IRP website and enter your username and password. If this is your first time using the IRP Portal, you will need to create an account. To create an account, you will need to authenticate your GSTIN and OTP. After you have completed the authentication, you will receive an email with your profile activation instructions. This will further help you begin using the IRP Portal to generate and track your IRN(s).

If your business uses an ERP or some other form of finance software to manage invoicing, you will need to enable your software to connect to the IRP via API. This will allow your software to send and receive data from the governmental system directly.

Once you have uploaded the JSON file containing the invoice to the IRP, that same IRP will validate it using their internal validation procedures and assign an Invoice Reference Number (IRN). This IRN provides proof of the validity of an invoice for GST reporting. The IRN will also give you the ability to accurately report on all invoices in your GST return.

In addition to the IRN, a QR code containing transaction details (including supplier and buyer GSTINs, invoice amount, and HSN codes) will be generated by the IRP as a digitally-signed document. Businesses must ensure the e-invoice has been printed with the QR Code so it can be used for offline verification.

Your company’s accounting system should subsequently modify the initial e-invoice to create a final e-invoice based on the approved IRN and QR Code. All information on the recreated copy must match the information contained in the original. The only valid copy of an e-invoice under GST law is the validated version is printed with a QR Code.

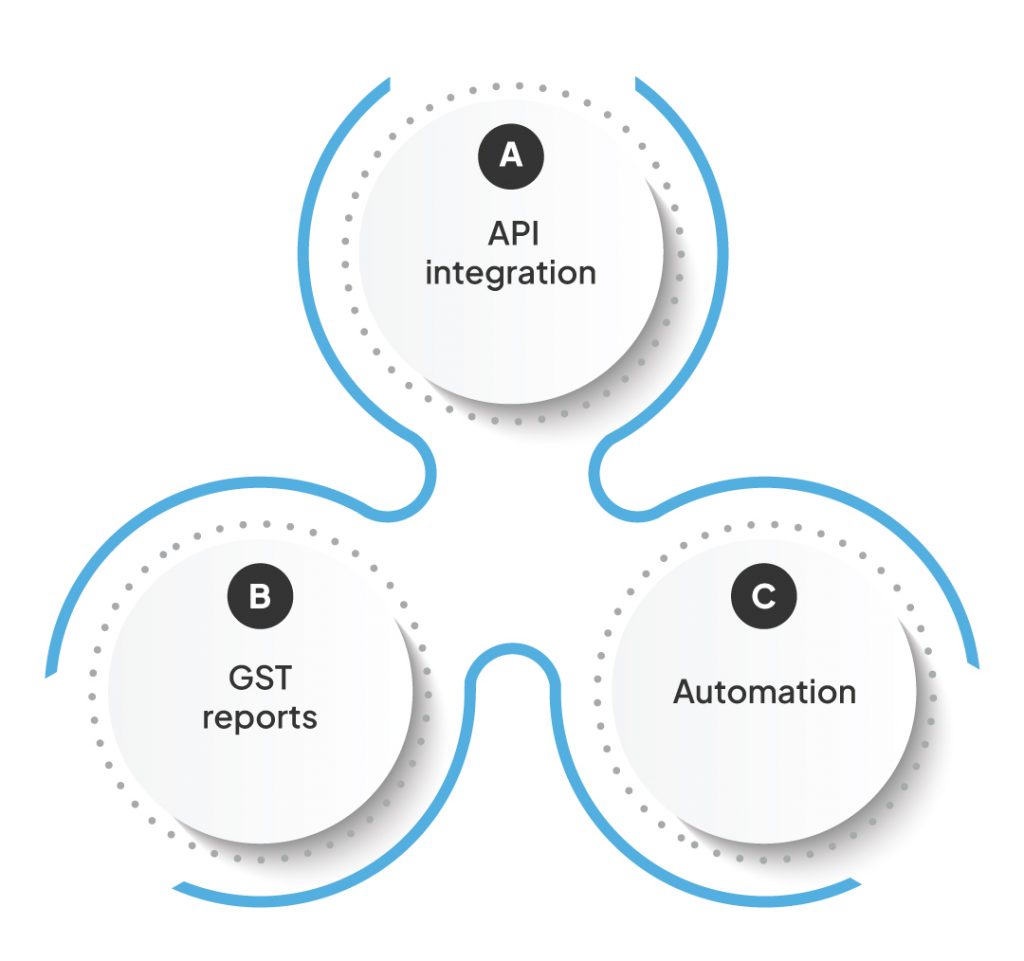

Selecting the right software to simplify GST e-invoicing setup is key. Manually entering data creates a higher potential for errors, delays, and rejection of IRNs. By using the right software, you can automatically generate invoices. You can also easily stay compliant, and make it easier for you to communicate with your IRP. As a result, invoicing for MSME’s will become significantly less cumbersome.

Entering invoices manually results in more errors with the information. Mistakes, even minor ones, can lead to an IRN rejection or GST mismatch. By using automated invoice creation software, the risk of mistakes decreases significantly. Plus there is a way for you to receive up-to-date information while invoicing.

A good invoice generation software product will provide easy and automated API integration. This will allow you to automatically create an IRN every time you enter an invoice without having to sign into the IRP each time.

A good invoice software product will automatically populate your GST report and GSTR-1 data when you send out your invoices, significantly reducing the time and energy you will need to monitor compliance. Automatic report generation will also assist in avoiding reconciliation difficulties and allow you to meet your reporting deadlines.

A good invoice software product will automate repetitive tasks, such as customer information collection, real-time validation of invoices, detection of duplicate invoices, and automatic QR code embedding. Automating these tasks will allow you to concentrate on higher-value tasks. This can be done while simultaneously enhancing your ability to create and send out accurate invoices.

VasyERP provides MSMEs with an easy-to-use tool that automates regulatory compliance by seamlessly integrating with multiple different systems via API integration, allowing users to generate IRNs automatically, validate transactions on the fly with real-time validation, and generate invoices in accordance with the government-compliant GST Invoice format.

Incorrectly entering data into the software system is one reason many MSMEs struggle after implementing the VasyERP solution, while other common mistakes include failing to correctly understand various rules and regulations associated with the E-invoicing process. By being aware of these mistakes, companies can streamline their internal processes. They can also smartly reduce the likelihood of an IRN being rejected.

The incorrect selection of the HSN Code or Service Accounting Code (SAC) results in immediate IRN rejections, so it’s important for MSMEs to continue updating their item master with the correct classification of their items and the applicable GST Rate as part of their day-to-day operations.

Missing the GSTIN of their customer results in a rejection of the invoice by the Invoice Registration Portal (IRP). Therefore, MSMEs must ensure that they verify the GSTIN of their customers through the GST portal before generating an invoice.

Uploading the same invoice twice can create a duplication error. Quality software prevents duplicate IRN generation by comparing the invoice number and document type.

Invoices must follow the government-prescribed schema, meaning the invoice must contain all mandatory fields, be formatted correctly, and conform to the appropriate data structure. Quality software will solve this issue immediately.

E-invoicing is no longer an option for many businesses, and small and medium-sized enterprises must implement it to maintain compliance, efficiency, and competitiveness. Early preparation for e-invoicing builds an efficient process. It also helps reduce the risk of late or rushed job functions when implementing this government-mandated function. Furthermore, the implementation of the E-invoice authentication system will allow HSMS to minimize manual errors. It will help increase reconciliation speed and ensure proper GST (Goods and Services Tax) compliance. Plus it will also help decrease payment processing cycles. These benefits play a vital role in MSME’s ability to achieve growth and be competitive in their industry.

By making the transition to an automated end-to-end invoicing solution provided by VasyERP, you will be able to reduce errors. You will also have an accurate GST filing process. Start e-invoicing today with VasyERP. Schedule a demo today and see how easy it will be to automate the entire process for you without having to deal with the hassles of an e-invoicing system.

1. What is e-invoicing for MSMEs?

The process of e-invoicing entails the electronic validation of B2B invoices. This is primarily done using an Invoice Registration Portal approved by the Government. When the invoice is submitted, the Repository checks the information provided. It then provides a unique identifier called an IRN and generates a QR code. This makes the invoice legally acceptable under GST. For MSMEs (Micro, Small and Medium Enterprises), e-invoicing helps to eliminate manual errors. It also helps facilitate enhanced reporting and provides for quicker payment. All invoice data can be directly submitted through e-invoicing system to GST returns with no additional input.

2. Which MSMEs are required to follow e-invoicing?

All MSME’s with an annual revenue of ₹5 crores or greater must implement e-invoicing if they have had that level of revenue for at least one year from the beginning of the 2017-2018 fiscal year, based on the Taxation number (PAN) and not based on the GST tax number. Compliance will be required for all B2B, export and SEZ (Special Economic Zone) invoices, regardless of the type of industry, location or place where the MSME operates.

3. Are any businesses exempt from e-invoicing?

There are some categories of businesses that are not subject to e-Invoicing even though their revenues exceed 500 million rupees. Examples of business categories are: Banks, Insurers, Non-Banking Financial Companies (NBFCs), Goods Transport Agencies, and more. Additionally, pure Business to Consumer (B2C) operations will be excluded. However, if a B2C entity generates even one Business to Business (B2B) Invoice and its revenue exceeds 500 million rupees, it will need to start implementing e-Invoicing.

4. What do MSMEs need before starting e-invoicing?

The following information must be in place before an MSME begins using e-Invoicing: A current GST registration number, 2) current GST registration information, 3) Aadhaar linked to the GST registration, and 4) access to the IRP Portal and billing software. The MSME should also have a complete item master, correct HSN codes for the items to be invoiced, customer GST Numbers, and customer addresses configured correctly prior to using e-Invoicing. Having the above prerequisites in place will ensure quick and seamless onboarding of a MSME to the e-invoicing system and will help avoid the potential for technical errors when generating the accurate IRN’s.

https://youtube.com/shorts/kPdW1ZGLUKQ?si=lfcV9sm6yjHYY...

February 13, 2026

Introduction The future of retail billing is digital...

September 1, 2024