How to Generate E-way Bills for Delivering Goods?

September 24, 2024

Want to generate an E-way Bill? This guide is for you! We have discussed how to generate E-way Bills and outlined the complete process of generating E-way bills for your business in easy steps.

In India, given the current world of logistics and transportation, businesses need smooth GST compliance. However, many companies, especially retailers and wholesalers who have to send deliveries of their goods, struggle with generating GST-compliant E-way bills. This is where you can count on a software system that automatically and with a click to generate E-way bills and makes the supply of goods and on-road GST compliance bills super easy for you.

Ready to dive into the details? Let’s get started with navigating e-way bill generation!

As per the Indian Government’s official website for E-way Bills, The E-Way bill system is for GST-registered entities or businesses or enrolled transporters. This portal is for creating the document (the E-way Bill) that one should keep with them when they are transporting goods that are valued above INR 50K. This bill is mandatory for the movement of goods within or outside the Indian states.

In short, it’s a legal digital document for businesses that are transporting goods worth over ₹50,000, either within a state or between states in India. Consider it as a way of having your products transported without any issues by the road transport office or GST officers.

CA Chirag Chauhan reported to The Hindu Business Line that the creation of e-way bills drove a substantial 80% recession in tax evasion, marking only a 2-5% decline in GST collections. If your business includes transportation practices, or selling goods through retail shops, then you must learn to generate E-way bills.

Just knowing what an e-way bill is won’t be enough to let you easily generate it. You need to have certain particulars available to generate it, and it’s important not to miss out on them. Any omission may cause delays, penalties, or even worse. So, take some time before finally clicking ‘Generate’.

After you gain entry, generate e-way bill easily at any time you wish to do so. Ensure you keep your login credentials confidential and restrict the portal access to authorized staff only, especially for an e-way bill for retail needs.

2. Invoice/Bill/Challan : You also need a valid invoice or challan for moving goods. This document is a foundation of your e-way bill, which will indicate the nature of goods, their total cost, and applicable GST rates. Check if there are any discrepancies on the invoice/challan because this could create unnecessary issues during transportation – especially concerning retail-oriented e-way bills.

3. Transporter Details: Should your goods be travelling by road, rail, air or ship, then ensure you have details about your carrier ready. In case of road transport, ensure to include transporter ID/Vehicle Number, and for other modes’ transporter ID along with transport document number and date on which such document was issued are required. These pieces of information are necessary for ensuring that the goods remain traceable throughout their transportation by making sure that a single e-way bill covers all legs/routing involved, including an e-way bill for retail supplies. It is necessary to generate e-way bills correctly to smooth operations.

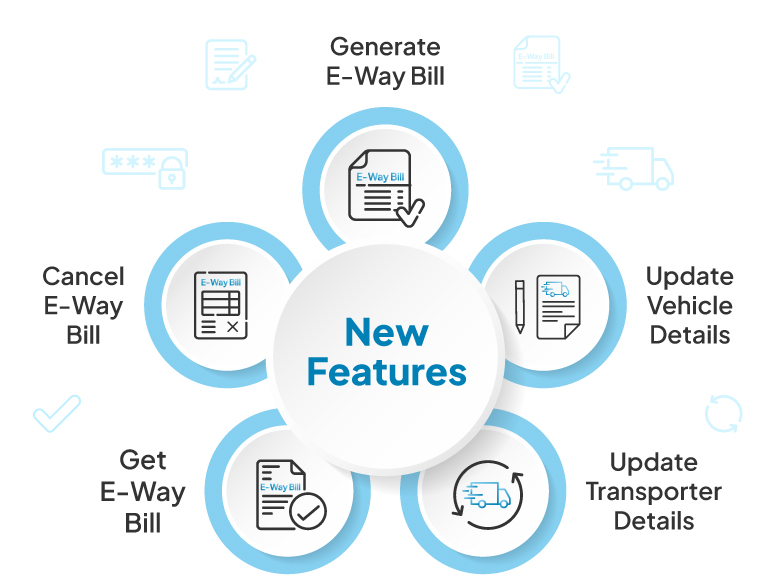

The E-way Bill System has evolved with the introduction of new features on the e-way bill APIs. These features are designed to ease your billing by automating many of the tasks involved in e-way bill generation. These API tools are a big help when it comes to running efficient e-way bill operations, especially in fast-paced retail logistics environments.

Here’s what the new APIs can do:

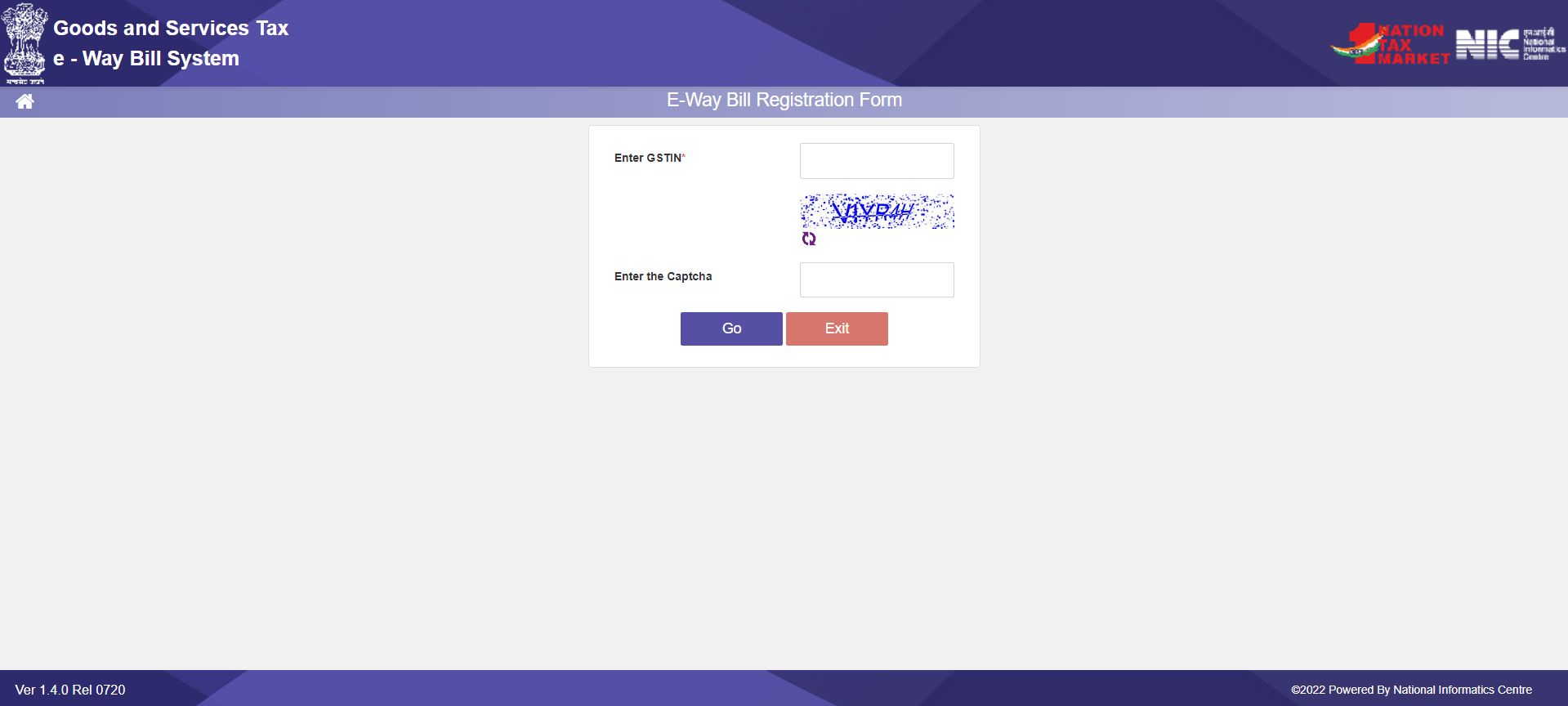

Step 1: To get started, E-WayBill System is the first place to visit or access it through your POS software that has inbuilt e-way bill integration. Enter your GSTIN number and password as required. Ensure that only authorized individuals have access to this information due to its confidentiality. Moreover, consider changing your password frequently, along with observing other best practices for digital security.

Step 2: From the main menu, select the “Generate New” option, which will prompt the initiation of a new electronic waybill. Billing software platforms can streamline this part, so don’t drain yourself much on this—it has a friendly and smooth user interface to assist you.

Upon registration of the GSTIN, corresponding fields might be populated by default, thus minimizing manual effort and reducing chances for mistakes. As always, verify this information, since even slight inaccuracies can cause compliance problems.

Step 4: Simply complete by entering item details such as the value of goods transported and mode of transport. These item specifics include a description of what the products are about, how much you have in stock, plus the rate at which taxes applicable are being charged within them. The total value has to match invoice values, including taxes.

Step 5: Submit all filled sections to acquire a unique E-way bill number or an EBN through this form. A transporter may request this during transit to prove that he/she carries authorized commodities on behalf of the shipper, who must also communicate with relevant authorities along these routes regarding the same thing too. If yours happens to be an electronic waybill system then after submission, one automated step follows where your record keeping would store its EBNs, unlike manual ones, having duplicates only kept for filing reasons. You can generate e-way bills effortlessly through this streamlined process.

Clear knowledge of the legality of an e-way bill can help you prevent compliance problems, while your products are en route. The validity of the e-way bill depends on the type of vehicle as well as the distance your goods cover. Know the specifications:

But what if something happened unexpectedly—natural calamities or road closures that prevented the timely delivery of your goods? Don’t panic, you can extend the validity through the portal! Keep in mind, however, that it must be done before the expiration of the original validity term, otherwise, you’ll have to give a reason behind continuing to use it beyond its time limit.

Financially speaking, failure to adhere to e-way bill regulations can put you in financial distress. Non-compliance penalties can be severe, such as:

And, if tax evasion is intentional or isn’t accompanied by proper documentation during transportation, then expect more severe legal consequences. So, one has to pay maximum attention to these laws, as there may always exist surprises concerning an e-way bill.

India’s logistics and transportation sectors are getting more efficient through the introduction of the E-Way Bill system. It digitizes paperwork, which translates into less bureaucracy, more transparency, and GST compliance. This has been associated with shorter transit times for firms, lower logistics costs, and fewer penalty risks.

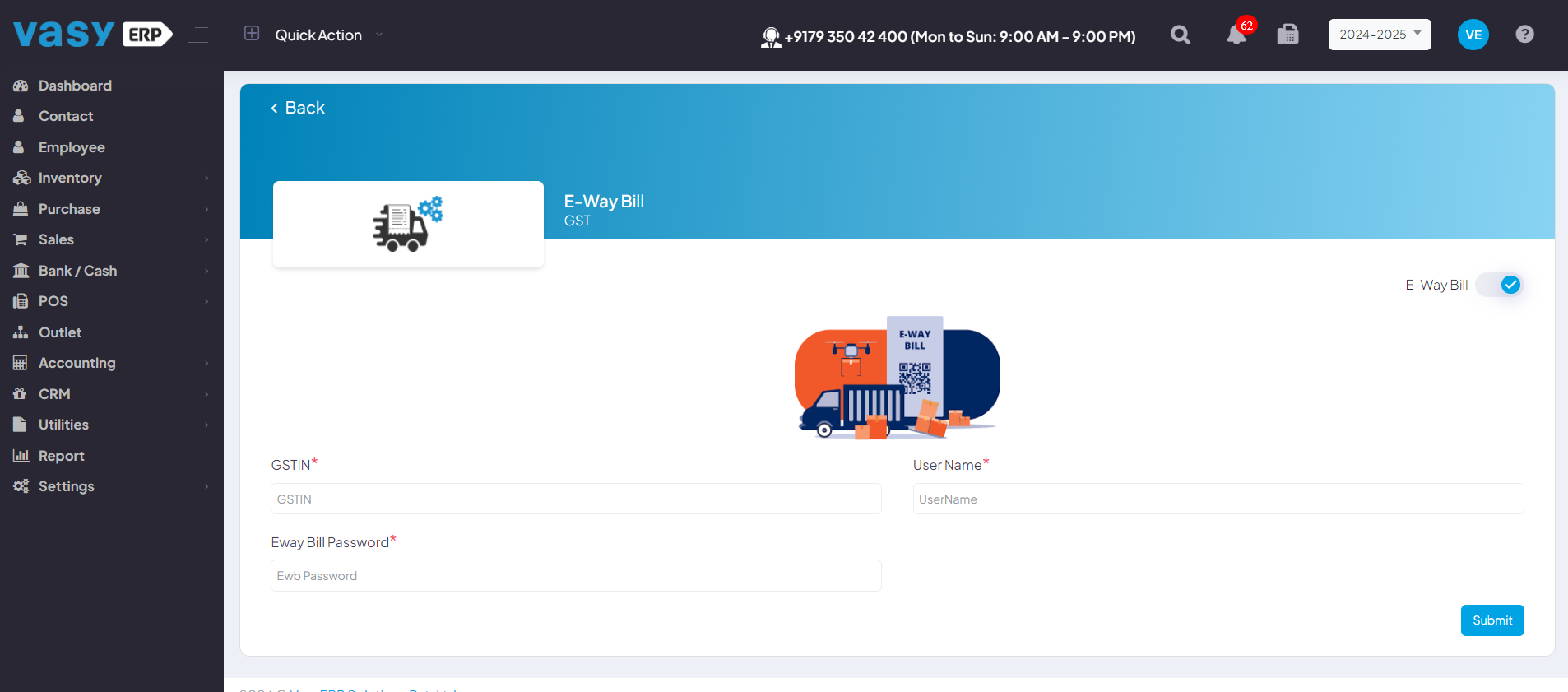

While this article has explained in detail the complete process and requirements to generate e-way bills, in case you still want an easier way to generate e-way bills, you can use VasyERP POS software that comes with e-way bill integration.

Whether it’s e-way bills for retail or other businesses, VasyERP POS and billing software solution will simplify your entire e-way bill generation process. It will only take a moment before all deals within your organization become efficient, sticking to compliance.

Being a retailer, do you ever struggle to maintain the ...

May 6, 2024

Many business workflows include receiving documents in ...

April 17, 2025