Confused About GST 2.0- Here’s How VasyERP Makes Compliance Effortless

September 11, 2025

GST 2.0 compliance is becoming a major concern for retailers and businesses. This blog explains GST-2.0 changes effective September 22 and how VasyERP helps businesses manage old vs. new stock, pricing, billing, compliance, and automation seamlessly across branches without manual errors.

On September 22, the Indian government will introduce GST-2.0, and many businesses are confused about how to comply. Distributors, wholesalers, and retailers are asking how GST-2.0 compliance software like VasyERP can help manage stock, billing, and pricing accurately.

Many small and medium-sized businesses are concerned since a tax update often involves hours of manual labour, the possibility of errors, and concerns about penalties.

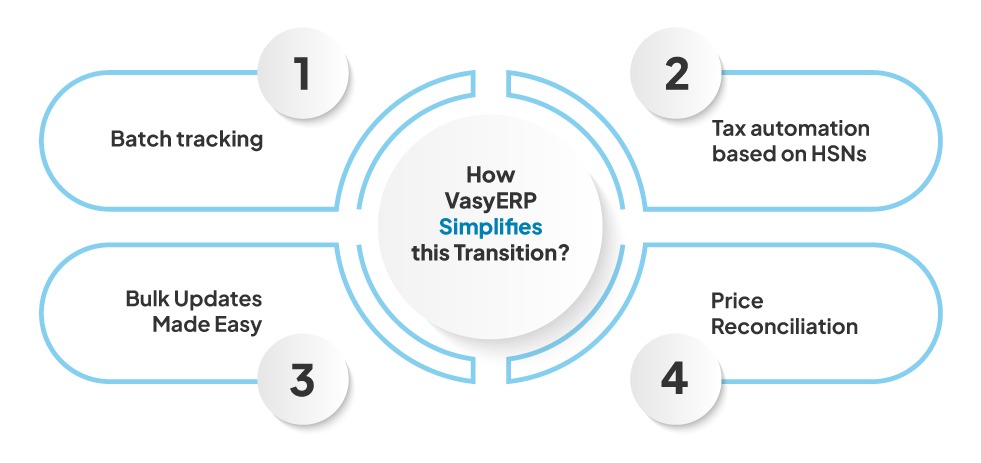

The good news is that there is nothing to be concerned about if you are already using VasyERP or want to purchase it. GST-2.0 compliance is already seamless due to the ERP system’s design. The automated features of VasyERP will handle everything, so you don’t have to worry about how and what to alter. You just keep operating your business.

To understand the importance of GST-2.0, check what is actually changing. Also, you can refer to GST Update 2025 Explained

If everything is clearly mentioned, then why is there confusion? The majority of companies have the same queries:

VasyERP takes care of all these very real concerns.

Managing old stock vs new product is the largest challenge retailers face during tax migrations. Let’s take an easy approach.

Assume that on September 15th, you bought 100 cartons of biscuits at the previous 18% GST rate. Since you haven’t sold them yet, biscuits will now be subject to a 12% tax rate under GST-2.0, which goes into effect on September 22. To stay in compliance, you must charge the new GST rate of 12% rather than 18% if you sell these cartons after September 22.

What Does This Mean to Retailers?

This creates two issues:

New purchases made on or after September 22nd will be automatically billed using the updated GST slab. For example, if you buy biscuits from your seller on September 23, the 12% GST will already be shown on the purchase invoice, and that rate should also show up on your resale billing.

This is how VasyERP simplifies a retailer’s life:

VasyERP guarantees compliance by automatically ensuring, through sales, that the invoicing for both new stock and old stock are compliant.

If you are an existing VasyERP user, it will be much easier to switch to GST-2.0. Here’s how it works:

You do not need to update the new GST rules manually. The VasyERP system will automatically upload the new slabs and alerts on September 22.

What if you have 15,000 SKUs across multiple locations? If this were any other system, it would take weeks to manually change everything. For VasyERP, it’s simple:

Are you concerned about generating reports or filing properly under the new GST rules? Your digital invoices are compliant with GSTN systems based on VasyERP’s e-invoice & e-way bill link. There are zero manual adjustments needed.

VasyERP is cloud-based; therefore, changes are instant and visible across all branches, users, and devices. Changes are now visible immediately to the accounts team, billing counters, and retail personnel.

Are you considering the purchase of software just ahead of the GST-2.0 launch? You have made a smart decision. Here’s why:

| Confusion | Retailer Concerns | Solution by VasyERP |

|---|---|---|

| Old vs New Stock | “Do I apply the old rate or new?” | Batch tagging + sale-date GST ensures correct tax automatically. |

| Manual Re-pricing | “How will I change 5,000 product prices?” | Bulk GST + price updates in seconds. |

| Reporting | “Will my returns mismatch if I make an error?” | Integrated e-Invoice & GSTN-ready reports = 100% accuracy. |

| Multi-Branch Stores | “How do I make sure all outlets follow the same rates?” | Cloud sync ensures the same pricing & GST rules across all outlets. |

| Invoice Compliance | “Will my bills show correct rates from the 22nd?” | Auto-updated billing templates generate compliant invoices. |

To make life simple, here’s a quick GST-2.0 readiness checklist:

The modifications of GST-2.0 cause confusion, worry, and restless nights for retailers. But if you choose the right ERP systems, the whole process can be easy, automated, and without problems.

VasyERP simplifies GST compliance by:

So, VasyERP makes sure that you are 100% GST-2.0 ready, whether you have been a customer for a long time or want to sign up right away. You won’t have to waste time or money.

Read this blog and learn the steps to take offline stor...

August 8, 2025

https://youtube.com/shorts/g8rM8H2WsQg?si=j9sx9EHNmb_2w...

May 14, 2024