Small Business Accounting Basics: A Beginner’s Guide for Non-Accountants

November 7, 2025

Small business accounting doesn't have to be complicated! In this beginner's guide, we will break down the small business accounting basics: What are the small business bookkeeping basics? Key terms in accounting? What are financial statements? In this post, you will also learn how to set up accounting, what software to consider such as VasyERP, and avoid costly mistakes that small businesses make with accounting, which ultimately wastes time and money!

Every business, no matter how small to great, runs on numbers. Accounting is the language of business, which allows us to understand where our money is received from and where does it go. However, for a lot of small business owners, small business accounting basics can be a confusing world of ledgers and spreadsheets.

We are looking to change that with this guide! This accounting guide breaks down the accounting basics for non-accountants in simple, everyday understanding with no jargon or heavy math. Whether you are a freelancer, the owner of a retail store, or a startup business we want you to be confident about the fundamentals!

At the end of this article, you should be able to track transactions, understand basic accounting for small businesses, read financial statements, understand important accounting terms, and confidently use reliable accounting software by VasyERP to manage your numbers.

We want accounting basics for non-accountants to be less intimidating – and more empowering, as a small business owner!

Bookkeeping is solely about documenting each transaction, such as sales, expenses, payments and receipts. Think of bookkeeping as your business journal, a professional bookkeeper ensures your journal entries are correct and up to date.

Accounting, on the other hand, is the process of analysing bookkeeping records to gauge the financial condition of your business. Accountants prepare accurate financial statements, analyse recent trends, and produce recommendations to help your financial decisions.

What you need to do: As a small business owner, you should know your daily cash flow, small business bookkeeping basics, tracking invoices, and documenting each transaction. Simple basic accounting for small business can easily be handled using accounting software.

What to outsource: Activities such as preparing tax returns, financial reports, or compliance should be completed by an accountant. They are familiar with the rules and regulations and will ensure accuracy and save you time.

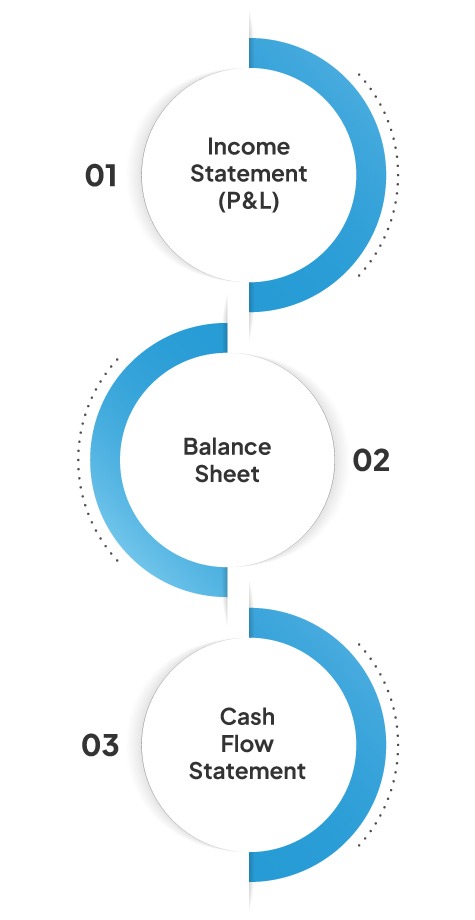

The income statement is also known as the profit and loss (P&L) statement because it describes the revenues and expenses for a period of time, including the profit or loss. For example, your company could have earned 10,000 in revenue and spent 7,000 in expenses, generating a net income of 3,000. A company uses the income statement to review profitability periodically, such as monthly or yearly.

A balance sheet shows the financial position of your business on a specific date. The balance sheet breaks down what your business owns (assets), what your business owes (liabilities), and what the owners of the business owns (equity). For example, if your company has 20,000 in assets (what you own) and 8,000 in liabilities (what you owe), then you have 12,000 in equity (or net worth). The balance sheet is called a “balance sheet” because the two sides, the assets and the liabilities + equity, need to balance.

The cash flow statement records the movements of cash in and out of your business. A cash flow statement for a business is separated into operations, investing, and financing activities. It is so important to have access to the cash flow statement because the business might show profits on paper but run out of cash. Tracking cash flow makes sure that you can pay bills, reinvest, and keep things operating.

It is hard to choose the best accounting tool for your small business since there are so many options available today, however, the goal is to have a program that will make your job easier, provide time-saving functions, and cut down on manual processes, all without the need for in-depth knowledge of small business accounting for beginners.

Managing your small business’s finances is easier to do when you have great accounting software. It can make all the difference in managing your small business finances while maximizing simplicity. VasyERP’s accounting software is built with simplicity in mind for business owners who are definitely not accountants but still want a system at a reasonable pace and accuracy. Consider some of the key features and benefits of VasyERP’s accounting software below.

| Key Features for Non-Accountants | Benefits |

| Simple User-Friendly Interface | Easy grouping of transactions without any accounting knowledge |

| Automated invoicing and expense tracking | Time-saving, reduces chances of manual errors |

| Real-time Access to Financial Reports | Make knowledgeable business decisions quickly |

| Secure Cloud-Based Data Storage | Keeps accounting data safe and accessible at all times |

| Integrates with Payment Gateways and Banks | Easily manages transactions to improve cash flow |

If the owner uses one account for both personal and business expenses, it will likely make the entire record-keeping process muddled, and tax filings can become complicated as well. For example, if the owner buys groceries with a business card, it can throw off the expense reports. You should always have a separate business bank account and business credit card so you can keep your finances clean and organized.

The owner must keep track of small expenses like parking and coffee when meeting with clients. These small expenses can add up to hundreds or even thousands of dollars a year, so it does add up. When the owner forgets to keep track of expenses it will not report an accurate amount of profit. Always collect every receipt, whether paper or digital, and use a tool like VasyERP to help categorise and track expenses throughout the year.

When your books and bank statements don’t agree with one another, you are at risk of missing fraud, double charges, or forgotten transactions altogether. Reconciling your accounts every month will ensure that everything is properly reconciled. For example, if your bank says you have $5,000, but your books say you only have 4,800, the process of reconciliation will quickly point out where the 200 discrepancy is.

Available cash flow amounts can still get you if you have a successful business. You could have $10,000 in pending invoices, but only have $500 in the bank, which makes paying your rent or suppliers more difficult. It is important to know when cash is coming in and going out of your business, so you can have enough available cash on hand for your daily operations. This is why you should track cash flow weekly.

Forgetting tax deadlines leads to penalties that are unwarranted, in addition to unwanted stress. Many small business owners miss deadlines because they simply forget them. To avoid this issue, determine ahead of time when deadlines are; put reminders in your calendar or your accounting app. For example, VasyERP gives you an automatic notification ahead of time of your filing dates to assure you are compliant and avoid the last minute scramble.

When you lose your accounting information because your hard drive failed, or you are a victim of theft, all that you’ve recorded for the past few months could be history. A proper backup system fixes that. Cloud storage is a safe way to back up documents. Or, you could use software like VasyERP, which backs up your accounting data for you online – the data is stored in the cloud and continues to be stored online even if your computer fails.

When you try to manage something as complex as accounting for small business owners on your own, it can lead to inadvertent mistakes that can be more costly to fix than if you had sought help earlier. If you’re challenged by taxes, payroll, cash flow, etc, it might be time to engage a professional. A qualified accountant engaged from the very beginning can save time, lessen anxiety, and help keep you in compliance from day one.

Accounting for small business owners is more than just counting numbers. It is indeed about knowing your business better. When you have control of your money, you can make confident decisions, think strategically about how to grow your business with accounting software, and protect your business from unnecessary risks.

You are now equipped with the knowledge to manage your business finances, starting from basics in small business accounting for beginners and important accounting terminology to understanding financial statements and establishing your accounting system. With a reliable accounting software by VasyERP that is easy to use, anyone can manage accounting for small business owners without fear, for most non-accountants, accurately.

The most important habit will be consistency – record each transaction, review your reports on a regular basis, and of course, do not hesitate to get professional help where required.

If you are ready to take the next step, VasyERP has got you covered.

1. What’s the difference between bookkeeping and accounting?

Bookkeeping concentrates on documenting daily financial transactions these transactions can be from sales, purchases and expenses. Accounting for small business owners takes the information from the bookkeeping side and goes a few steps further: it helps to analyze the information, creates reports categorizing the parties to the transaction, evaluates the data, and prepares it to allow for decision making. To put it simply, bookkeeping records your financial transactions while accounting reviews and interprets your records to help you with decision-making.

2. Do I need accounting software?

Yes. Accounting software allows for facilitated financial management. It automates things like data entry, invoicing and report generation. It simplifies the complexity of the recording process, allows to reduce any kind of human errors and also saves valuable time. An easy access program available to small business owners, that allows them real time and accurate insight, without getting lost in complicated spreadsheets or manual bookkeeping, is VasyERP.

3. What accounting method should I use?

Most small businesses start with the cash basis accounting method. The cash basis method is easy – a business records income when it has been received and expenses when the business spends the money. In addition, small businesses typically, with expansion, would use the accrual method for accounting for small business owners. The accrual method provides a more accurate and complete financial picture because it records a transaction when it is earned and expenses when it is incurred; therefore, the business is recording revenue and expenses independently from its cash bank account.

4. How often should I review financials?

Reviewing your financial statements each month ensures you are apprised of your cash flow, expenses, and profits. Continuing to review your finances regularly enables you to build awareness of inconsistencies, uncover opportunities for growth, and start handling problems before they become serious issues. Regular reviews of finances ensure you are aware of your situation and allow you to take charge of your business finances rather than work with surprises well down the line.

5. When should I hire an accountant?

You should hire a professional accountant whe your business begins to grow, you have a high volume of business transactions, or your tax situation becomes quite complex. An accountant is there to ensure accuracy and compliance, but obviously, to provide you with valuable financial information. Using the services of a professional in the earliest stages of business starts to give you back your time, keeps you from making costly mistakes, and provides stability in the long run.

It's not surprising that retailers feel overwhelmed by ...

August 31, 2023

Is your mind draining off by organizing your business f...

July 18, 2023